Savers could boost their pension pots by thousands of pounds by switching away from high charging accounts, potentially allowing them to retire earlier or enjoy a more prosperous retirement.

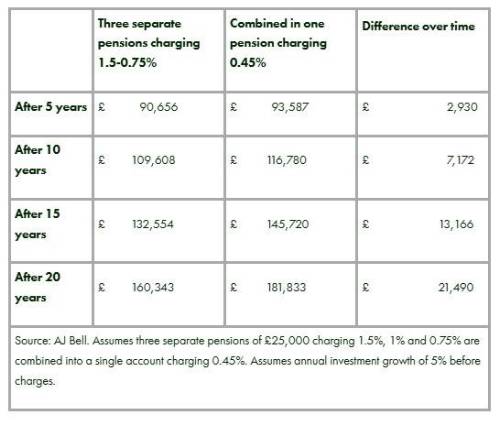

Figures from investment platform AJ Bell show that someone combining three pensions with charges of 1.5 - 0.75% could boost their pension pot by over £7,000 over ten years or £20,000 over 20 years if they were to switch to a single, lower cost account (see table).

Many people will have multiple pension pots, often set up when they were with an old employer. While a charge cap of 0.75% applies to the default investment option in auto enrolment workplace pensions today many pension policies, including older contracts or those setup outside auto-enrolment, may carry higher fees.

Past studies by the Financial Conduct Authority (FCA) have shown that charges on some older pensions, especially smaller accounts, can average around 2%**.

Analysis by AJ Bell illustrates how an individual with three separate pension pots of £25,000 charging 1.5%, 1% and 0.75% respectively could boost their retirement fund by over £20,000 by moving to a modern pension charging 0.45%:

AJ Bell director of public policy, Tom Selby: “For many people combining their pension pots could save them time and reduce hassle, making it easier to manage their retirement savings in one place. As these figures illustrate, it could also boost your retirement prospects, since higher charging pensions can eat away at your returns.

“It can feel daunting getting all the paperwork together to track down your old pensions, but there are tools out there that can help. The government has a service to help find pension pots, and firms like AJ Bell have launched tools that take the hassle out of tracking down pensions and combining them.

“Understanding what you’re paying for your pension is important. There are lots of different types of pension, some with different charges for various features and services. Generally speaking, the most significant fees will be for the administration of the scheme and for the funds in which the pension is invested. Sometimes these are given separately, while some pensions have a single fee covering everything.

“The important thing is to look at whether you’re getting good value for money. It’s possible to pay less than 0.5% for both administration and investment combined. If you’re paying more than that, especially if you’re paying over 1%, it’s important to make sure you’re getting something in return. If a fund is charging more for active management that can be worthwhile if it’s delivering outperformance that justifies the extra cost.”

How to combine pensions easily

1. Track down old pensions

The first step is to find all your pension accounts. That means going through your paperwork to find pension statements, getting hold of your account number and the name of the pension provider.

If you’ve lost track or mislaid the paperwork then services like AJ Bell’s can help make things easier. All you need to do is give some details about yourself, such as past employment history. The pension finding tool will tell you about any pensions found under your name and should be able to find most accounts, although some cannot be searched for this way. The service will show you the value of the pot and where it is held.

2. Decide where you want to move your pensions

If you find it difficult to keep on top of lots of pension accounts, you might want to move them all to a single account with one provider. There are lots of pension companies to choose from, so it’s worth taking some time to look at a few and see how their charges and service compare.

You also need to think about whether it’s sensible to move all your pensions. If you have a workplace pension that’s active and your employer is paying in, you’ll almost certainly want to keep this account open. You also need to be cautious about switching away from a pension that offers any special benefits, although the pension companies should alert you to this as well and may instruct you to seek advice first before transferring.

3. Choose one that works for you

When you come to make a decision it’s important to choose a pension that works for you. Some people will be more confident managing things themselves, selecting a range of funds and shares to invest in. Others will prefer a ‘ready-made’ option where you can allocate the money to a portfolio that’s designed to reflect your preferences for risk and reward, as well as any ethical considerations.

You should also consider when you’re likely to need the money and how you want to take it out. If you’re still some way from retirement then this is less of a concern, but if you’re at, or approaching, retirement then it’s worth considering whether the company you’re moving to offers what you want. Most modern pensions make it easy to move into drawdown and take tax free cash.

4. Moving your money

When it comes to moving your pensions into the new account, it’s a case of giving the provider your old account details and letting them do the heavy lifting. Once they have your account details and authority to move the money, the pension providers should be able to communicate between themselves to move the pension assets. It can take some time to complete the process, but the new company ought to be able to keep you informed along the way.

*Analysis assumes three separate pensions of £25,000 charging 1.5%, 1% and 0.75% are combined into a single account charging 0.45%. Charges include all fees for investment and product administration. Annual investment growth of 5% before charges.

**FCA: Effective competition in non-workplace pensions (FS19/5)

|