The UK population is ageing, with the number of over 85s expected to more than double to 3.2 million by 2041 and account for just under 5% of the total population1. With council budgets being squeezed, it looks increasingly likely that people will have to take greater responsibility for meeting the cost of their own care in later life.

With billions of pounds tied up in the value of retired people’s homes, property is an asset that looks likely to make up a significant proportion of how people fund this care, at least in the short to medium term.

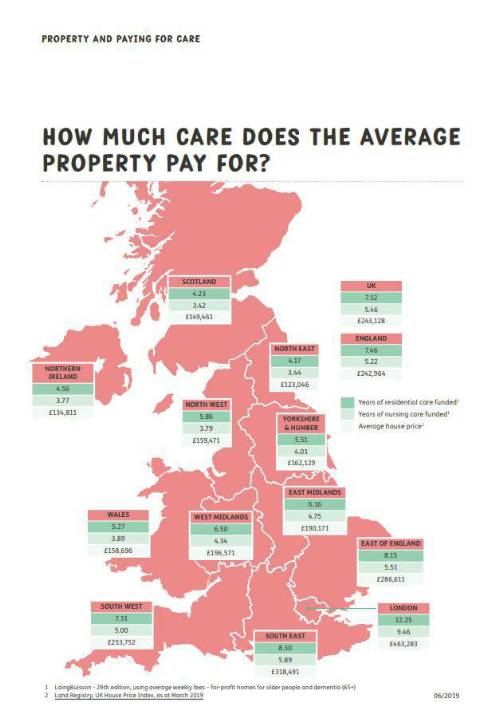

Property prices vary hugely across the country – for instance, the average house price in the North East (£123,046) is substantially less than in London (£463,283)2 where prices have rocketed over the past decade.

And the cost of residential care also differs by more than £200 a week (£11,180 a year)3 throughout the country, with the lowest average weekly charges in the North West at £523 a week and the highest in the South East at £738.

Nursing care costs vary even more, albeit across similar regional lines with treatment in the North East coming in at £688 a week compared to £1,039 in the South East and £1,001 in London.

So, we combined these three factors to see just how much care the average house would pay for across the country – please see on the next page.

Stephen Lowe, group communications director at Just Group, said: Most people have an idea of the standard of care they would like but only a few – just 8% of those aged over 65 according to research carried out for Just Group’s 2019 Care Report4 – make specific savings plans for meeting care costs, leaving the money to be found elsewhere.

“Most working people prioritise buying a house and it is often their most valuable asset. Under current rules, that value has a crucial role in helping people afford care they might need in the future.

“Our research shows how radically different the picture of paying for care through housing wealth is across the country – with no obvious winner. Londoners could find their average £460,000 in property wealth all used up to pay for care over a 12-year period, while the £125,000 average house price in the North East may only fund four years of care before they become fully dependent on what the State can offer them.

“It provides peace of mind to put in place your own plans. That will mean talking with friends and family about what you would like to happen. The Society of Later Life Advisers website is also a good place to start, while a specialist financial adviser can also provide invaluable help.

“These conversations should help with working out how to meet the cost whilst still retaining some financial control. For example, there are products such as an Immediate Needs Annuity, which can help those with assets avoid the risk of losing all their wealth in care fees, but very few customers know about them.”

|