|

|

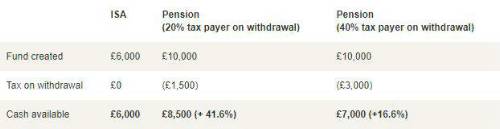

With a million more people set to be dragged into the higher rate of income tax in the next four years, NFU Mutual are reminding those in their 50s they could be thousands of pounds better off prioritising investment in pensions over ISAs. |

While money can normally be taken from ISAs at any time, flexible pension rules mean investors can access pensions from 55-years-old (57 from 2028) taking the money as lump sums if they wish. The impact of pension tax relief means returns could be boosted by up to 41.6%.

Example:

Investor with £6,000 to invest

Higher rate tax payer with earnings of £60,270 Plans to invest for five years Assumes no growth and no charges

Sean McCann, Chartered Financial Planner at NFU Mutual, explained: "Many people prioritise ISAs over pensions because it allows them to access funds if they need to. "Once you reach 50 and over, the point at which you can take money from your pension draws closer. "For those looking to invest for five years or more, the tax relief available can give a significant boost to returns, particularly if you’re going to be in a lower tax band when you take the money out. "Latest figures show nearly four million people between 55 and 64 hold ISAs, but many of them could be better off topping up their pension and claiming the tax relief. "It’s important to remember that once you take a taxable payment from your pension, your future pension contributions are limited to £4,000 each tax year." |

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.