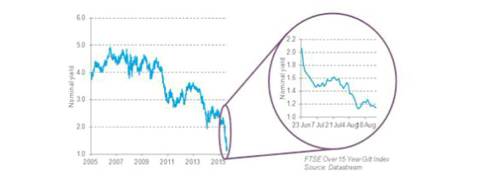

Ben Gold, Head of Investment Consulting, Leeds commented “Most pension schemes currently use gilts as the start point for valuing their liabilities. This funding approach labels gilts as the least risk asset, driving the trustees of those schemes to want to hold gilts to back their liabilities. This means schemes’ unsated appetite for gilts is right now in excess of £1tr. Yet there are only around £400bn of long dated gilts, and new issuance is modest. The latest round of QE announced at the beginning of August will add to the demand. The resulting supply/demand imbalance isn’t going away. Indeed I think it is very plausible this problem is going to get worse, because the gilt market is not working efficiently.”

Dealing with the consequential deficit increase is a huge headache for schemes.

So what can schemes do? One answer is to adopt a Cash Flow Matching Investment and Funding Strategy.

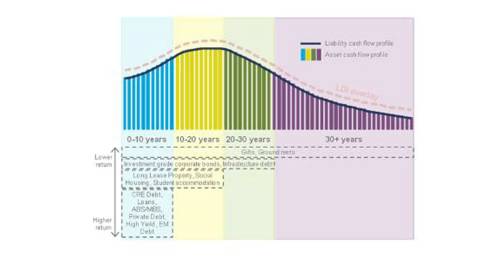

What is a Cash Flow Matching Investment Strategy?

A defined benefit pension scheme is simply a contractual obligation to pay a series of cash flows to the underlying members of the scheme. Trustees could align their investment strategy to this by investing in assets that provide contractual cash flows matched to the benefit outgo cash flows. Any asset that provides contractual cash flows may be suitable. The toolkit typically comprises a range of lending and property assets.

With a well designed Cash Flow Matching Investment Strategy there is a very high degree of certainty that a scheme’s benefit outgo can be paid since the scheme’s income is contractual. In this circumstance a change in the value of the assets should not impact on the required cash funding and hence should not impact on the scheme’s deficit.

Ben Gold added “Under a Cash Flow Matching Investment Strategy it is sensible and acceptable to value the liabilities in a different way, not using gilt yields as the start point. The cash flow matched liabilities should be valued directly in line with the Cash Flow Matched portfolio of assets – largely eliminating funding volatility. Schemes that adopt this approach would see a transformational reduction in funding volatility without requiring them to buy gilts. They would be far less exposed to the impacts of the broken gilt market we currently see.”

Example Cash Flow Matching investment profile

|