Analysis highlights how savers can increase their cash by over £200 by opting for best-buy savings rates. Those able to put money away for longer should consider investing which provides the potential opportunity for real returns on their money over the longer term

The Bank of England made the widely expected move of raising interest rates again, to 3%. While this is good news for savers, the increase in interest payments on cash savings is a long way off bridging the gap created by high rates of inflation.

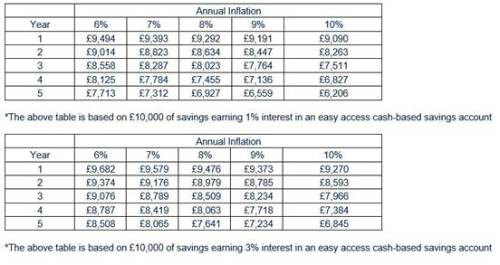

“Our analysis shows that even with an interest rate of 3%, higher than what is currently available on almost all easy access savings accounts, savings of £10,000 will be reduced to around £8,500 in real terms after two years if inflation remains at 10%. These figures highlight the importance of ensuring your savings are working as hard as possible for you. If your savings are earning just 1% interest then the real value after two years is around £8,260, a difference of £240.

“For those able to take a longer-term view, putting cash into investments via an ISA or pension provides the potential for returns that can match - or even beat - inflation over the longer term as well as additional tax efficient benefits.”

|