As concern grows around the sustainability of the State Pension, as well as the adequacy of minimum contribution levels under Auto-Enrolment to provide enough income in retirement for a moderate standard of living, new analysis from leading online pension provider, PensionBee, reveals the role parents could play in helping secure long-term financial security: by investing in a private pension for their adult children.

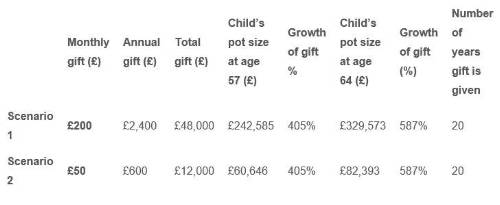

PensionBee modelled two different scenarios to illustrate the potential impact of passing on wealth to your child through pension contributions.

The first scenario revealed that if a 50-year-old parent gifted their 18-year-old child £200 per month as a pension contribution over a 20-year period, they would contribute £48,000 in total. At the typical retirement age of 64, the child’s pension could then be worth £329,573, almost five times the amount the parent paid into the pension, thanks to estimated investment growth and tax relief on contributions.

The second scenario explored a parent making a £50 pension contribution per month over the same time period. This would allow them to contribute £12,000 in total over 20 years, which at retirement, could amount to £82,393. While a much lower figure at retirement than scenario 1, this overall sum equates to over seven years of State Pension support, assuming the new full State Pension amount for 2024.

Becky O’Connor, Director of Public Affairs of PensionBee, commented: “The Bank of Mum and Dad is an untapped resource when it comes to boosting your retirement prospects; their funds are usually reserved for first home deposits. But there are a few reasons to consider boosting your adult children’s pensions.

“Younger workers feel unsure whether the State Pension will even still exist for them when they get older. Boosting their pension is one way to provide greater peace of mind that they will still be able to afford to retire at all one day, in the face of this uncertainty.

Equally, the minimum amount under Auto-Enrolment that people contribute to a workplace scheme, though very valuable, is unlikely to reach a pot size big enough for a moderate standard of living.

“The main advantage of additional payments to a pension when someone is young is that the growth has more time to compound. But many young workers may not feel like they are able to make additional contributions themselves if other outgoings and savings commitments are high. This is where paying into a pension for adult children can come into its own, in an act of forward-thinking generosity.”

Table 1: Parent gives adult child monthly gift as a pension contribution

Source: PensionBee, September 2023. Assuming the parent begins giving at age 50, when the child is 18 and stops giving at age 70. The pension pot attracts a 25% tax top up, and grows at an estimated 5% per annum, with a 0.5% annual management fee.

|