Some employers provide the option of buying extra days of holiday each year as part of a benefits package, but for those looking for the potential of additional years rather than days, a pension may provide the answer. Topping up pension contributions by just 2% over the course of a career could enable you to retire three years earlier, with nearly £20,000 more in your pot, compared to saving the minimum auto-enrolment rates new analysis from Standard Life, part of Phoenix Group reveals.

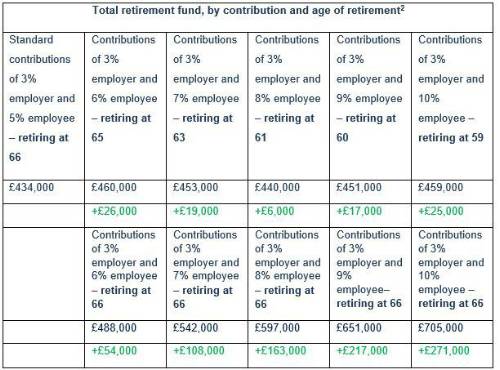

The analysis demonstrates the long-term impact that changing pension contributions can have on retirement outcomes. For example, someone that began working full-time with a salary of £25,000 per year and paid the minimum auto-enrolment contributions (3% employee, 5% employer) from the age of 22, could amass a total retirement fund of £434,000, not adjusted for inflation, at the age of 66* – the current state pension age.

However, if they were to increase their monthly contributions by 2% (7% employee, 3% employer) from the age of 22, they could amass a larger fund value (£453,000) by age 63 – gaining £19,000 and the option to retire three years earlier.

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures are not reduced to take effect of inflation. Annual Management Charge of 1% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Planning for a longer retirement

The challenge of contributing more and retiring earlier comes with a trade-off however and people choosing to retire earlier might need to make similar retirement pots last longer and spread their savings over more years.

For those looking to maintain a higher income in retirement, the figures show that paying in an additional 2% into your pension over the course of your career right up to the current state pension age would generate a pension pot of £597,000 or £163,000 more than based on standard contributions.

Another possibility is to consider a gradual approach to retirement, rather than stopping work entirely. Standard Life’s Retirement Voice research found that people have different definitions of retirement, with 52% of people thinking of it as something more gradual than stopping paid work altogether. It’s also important to remember that even after retirement, money left in a pension pot can continue to benefit from investment growth, potentially helping to support a longer retirement.

Dean Butler, Managing Director for Customer at Standard Life said: “There’s no one size fits all when it comes to people’s retirement goals, however consistently saving a relatively small amount more can increase your options and potentially buy you more retirement time. Pensions are both incredibly tax efficient and, over a number of years, allow for the potential of compound investment growth - meaning a little now can have a large future impact.

“Pensions aren’t always priority number one, particularly earlier in life, however increasing your contributions above the minimum levels is likely to pay off if you’re in a position to do so. Some employers match any contributions you make, giving your pot an even bigger boost.”

It’s worth noting that the pot sizes illustrated here shouldn’t necessarily be seen as ‘ideal’ – savings targets should take numerous factors into account, including people’s target standard of living in retirement and their other assets, and are best set with the help of a financial adviser. However, saving more, as early as possible, can give people more control over how and when they retire.

|