This doesn’t have to be a concern – a ‘guaranteed period’ protects the income stream for a selected term of between 1 and 30 years and can ensure the initial cost and more is paid out. That way, the income keeps flowing if you live to a ripe old age but, if not, it will be paid out to loved ones until the end of the term.

Annuities are the only way to turn a pension pot into a secure, regular retirement income that is paid to you for as long as you live, said Stephen Lowe, group communications director at retirement specialist Just Group.

“Most people can look forward to a long retirement but will naturally worry that if they get hit by the proverbial bus and die tomorrow, those years of pension saving will be lost. In reality, it is easy to ensure that whatever happens to you, more income is paid than it cost to buy.”

He said that ‘guaranteed periods’ are an option on all annuities and at current rates a 15-year guarantee will ensure that the value of the initial pension pot will be more than covered by the income it pays out even if the annuitant is unlucky and dies soon after purchase.

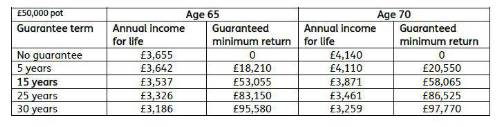

Buying a guarantee will reduce the annual income paid, but the reduction can be quite modest as the indicative rates in the table below shows.

A healthy 65-year-old using a £50,000 pension fund to buy a level annuity with a 15-year guaranteed period will receive £3,537 income each year for as long as they live - £118 a year less than if they had not guaranteed period. That’s less than the cost of a weekly high street coffee.

The guaranteed period means that, even if they themselves don’t survive 15 years, the income will continue to be paid until the end of the term. That’s a minimum return of £53,055 – more than the annuity cost to buy.

Under current tax rules, payments made during guaranteed periods are usually free from Inheritance Tax and would also be free from Income Tax if the annuitant died before they turned 75.

“We think guaranteed periods are an under rated option, with most people seeming to default to 5-

year guaranteed terms when a longer term might provide more peace of mind,” said Stephen Lowe.

“Guaranteed periods are just one method annuity providers offer to safeguard the money from premature death, alongside joint-life annuities which provide a lifetime income for both the annuitant and a beneficiary such as a spouse, or value protection which protects all or part of the initial pension lump sum used to buy the annuity.

“Annuities have many more options than people might think. Seeking the professional help of an independent annuity broker or regulated financial adviser can help you make best use of the wide choice of options available.

“They will look at your unique situation, first to help you to work out how much secure income you need, then they will help you work through the options in terms of guaranteeing the income or capital or choosing a level or rising income through the term, then scour the market for the best deal.

“It is important that they collect details of your health and lifestyle which can make a huge difference to the amount of income you are offered. Our experience is that two-thirds of annuity buyers would qualify for more than the ‘standard’ rates often published online or in newspapers.”

Annuity buying tips:

• The government’s money and pensions guidance service - www.moneyhelper.org.uk - has a useful online tool allowing quick comparisons of annuity rates and options.

• Employ an expert – an annuity broker or regulated adviser will work with you to better understand your goals, to choose the right options and shop around for the best deal.

• Full disclosure – providing details of your lifestyle and medical history is the only way to get a personalised annuity rate based on your unique situation.

• Don’t settle for less – take the highest offer because small differences in annuity offers can add up to large amounts over a long retirement.

|