By Alex White, Head of ALM Research, Redington

There are broadly two things a scheme might be looking to do when preparing a portfolio for climate change, and that’s reducing risk or making an impact on the global problem.

Reducing Risk

This can be complex, as not only is there the physical risk (e.g. buildings being flooded), but also the transition risk (e.g. carbon taxes). A coal plant on top of a hill may be well placed to provide power after a flood, say, but it would be a poor investment if carbon taxes were introduced.

But in general, most generic forms of risk mitigation will reduce both types. For example, moving from equity into credit, or from longer duration to shorter duration credit will reduce the exposure to physical and transition risk - simply by reducing exposure more generally.

Making an Impact on the Global Problem

This is arguably much harder. Some investments, such as renewable infrastructure, are likely to lead to a relatively quantifiable reduction in greenhouse gas emissions. Other investments, such as battery storage (or other green tech), will be more like far-out-the-money options, in that many will probably prove to be dead ends, but one or two may have an enormous impact. Alternatively, engagement and lobbying can cause companies to change their behaviours, and investors can use their position as shareholders or creditors to bring about change this way.

It is often difficult to take any ethical position with an institutional portfolio, as any actions have to be compatible with fiduciary duties. But climate change can be the exception here for two reasons.

Firstly, the direction of regulatory change seems to support more action.

Secondly, the stakes are so high that a scheme could argue it was within fiduciary duty to act to mitigate the risks posed by climate change - not just to the portfolio, but to the world. Put crudely, keeping the world habitable is likely to be in the beneficiaries’ interests.

However, there are certain barriers to bear in mind.

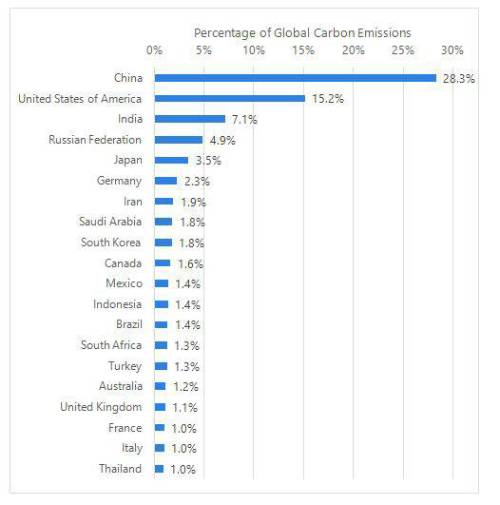

Firstly, global warming and greenhouse gas emissions will either be solved globally or not solved at all - it is a global, rather than local problem. The UK represents only around 1% of global emissions, so a total regulatory or societal solution in the UK would still be negligible on a global scale, though a technological solution might be transferable.

Secondly, the biggest reductions to be had are on the sources of the highest emissions. The Intergovernmental Panel on Climate Change (IPCC) estimates that natural gas contributes about half as much greenhouse gas emissions as coal , with other sources of energy producing much less greenhouse gas. There is currently no viable method of generating power that actively reduces levels of greenhouse gases. There are some with very low emissions and some with very high ones, so switching can reduce future emissions, but none yet exist with mathematically negative emissions.

This means that switching from the most polluting source to the second most polluting source reduces emissions by more than any other single action, at least in the short to medium term. Nonetheless, financing renewable infrastructure to help the transition from fossil fuels (especially from coal) is still better, and should have a reasonably significantly-sized and direct impact on carbon reduction.

Putting this all together

Climate change is a complex, global problem, with no easy solutions. Preparing a portfolio for climate change is simpler, but still not straightforward.

If you want to protect against risk, it’s possible to shift a portfolio away from the most exposed assets, or simply transition into generally safer assets.

Those wanting to make an impact can look to finance assets (such as renewable infrastructure) which reduce carbon emissions.

But before making any allocations, it is vital to be clear on whether the goal is to mitigate climate change itself, or just to limit the damage it might do to a portfolio.

|