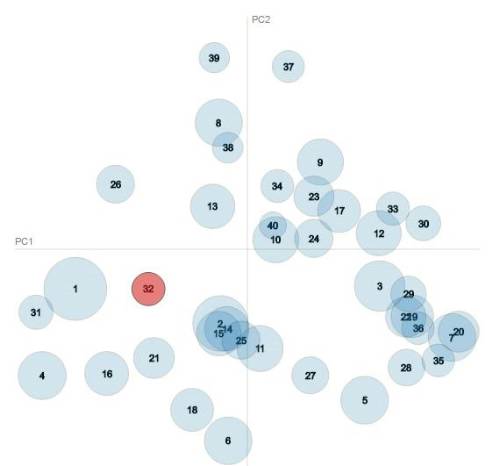

The algorithm identified 40 different “topics”. We can explore the meaning of each topic using an interactive visualisation – to start interacting click here.

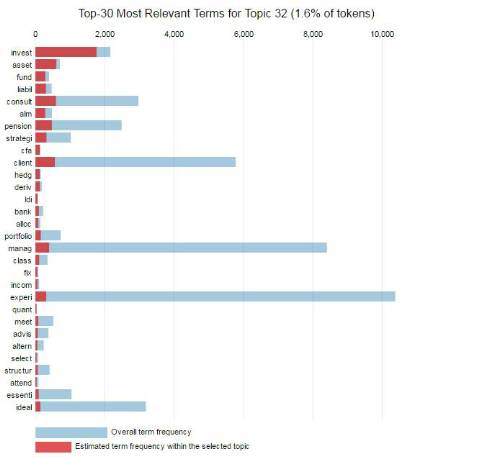

Clicking on bubble 32 allows us to reveal the most relevant words for that topic which are displayed below. This topic is best described as “Investment & ALM”.

Have a play with the visualisation and see how many topics you can identify.

What does an actuary do?

The algorithm automatically identified the major types of Actuarial work including Speciality Pricing (5) Capital Modelling (6/29) Pensions (10) Annuity Pricing (11), Reserving (13), Reporting (15) Personal Lines Pricing (16) Risk Management (18) Life (19/24) Prophet Modelling (21) Solvency ii (25) Catastrophe Modelling (27) Investment and ALM (32) and Marine/Aviation (35). The algorithm also detected softer skills such as Project Management (1) Leadership (2) as well as experience level such as Junior(36), Making Progress through exams (3), Newly/Nearly Qualified(20) and Seniority (7).

Expect the Unexpected

Having delivered several unstructured data projects in different industries one learning point stands out – expect the unexpected! Unexpected results include

• Online Casino Chat Logs – “We didn’t realise customers were having difficulty depositing with their credit card!”

• Insurance Company Loss Descriptions – “We shouldn’t be paying claims for that event– it’s not covered by the policy!”

Still we were surprised when we clicked on topic 26 to see a topic dedicated to French actuarial roles! Furthermore when we investigated the topics in the top right of the bubble chart we were fascinated to see they related to the various actuarial recruitment companies! The algorithm had managed to automatically differentiate between the role requirements and the recruiters “sales pitch”.

What did we learn?

Since the role of an actuary is well understood, we have essentially validated our machine learning approach as a method of discovering new and reliable patterns from new, unexplored data items. The next time we want to quickly understand a large collection of text documents we should consider using this approach. To learn more about this fascinating subject click here

Machine Learning Solutions provide training to actuaries in Machine Learning techniques as well as delivery of technical projects in predictive analytics across various industries. For more information visit here

|