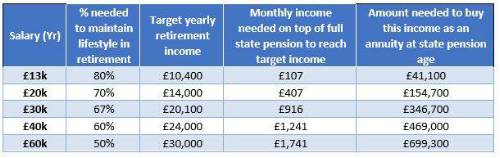

How much you need to maintain your lifestyle post retirement typically depends on your pre-retirement income. A government review in 2017 set out what proportion of pre-retirement earnings individuals would need to maintain their lifestyle in retirement (target replacement rates). For someone earning around £13,000 a year the percentage needed to maintain lifestyle is 80% and this gradually reduces as you move up the income bands.

Aegon analysis first shows the monthly income individuals across different income bands would need on top of the current full state pension (£175.20 per week) to maintain their lifestyle in retirement. It then calculates how much this would cost to buy as an annuity at state pension age.

Automatic enrolment has been successful in helping employees in workplace pension schemes build up additional savings on top of the state pension for retirement. But for most, the statutory minimum pension contribution for auto-enrolment of 8% between employee and employer, will not be enough to bridge the gap to the required fund needed to maintain pre-retirement lifestyles.

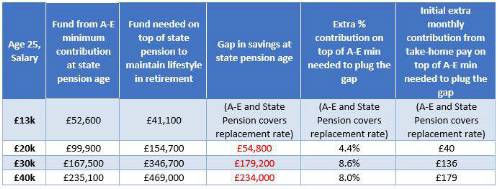

How much might the minimum auto-enrolment contributions grow to and how much more is needed to maintain lifestyle?

For an employee in their mid-20s earning £20,000 per year, Aegon’s analysis shows they could build a fund worth around £99,900 at state pension age by saving at minimum auto-enrolment contribution levels. This means they will need an additional £54,800 at state pension age (expected to be age 68) to maintain their lifestyle in retirement (targeting £154,700).

An extra 4.4% on top of the 8% auto-enrolment minimum is needed to close this gap in savings. This could be achieved with relatively modest additional contributions starting at £40 from take-home pay. Some employers will ‘match’ additional employee contributions, which will reduce this amount by half to £20 per month.

For employees on higher salaries, it will require greater additional savings on top of the auto-enrolment minimum to maintain living standards.

Age 25, Salary Fund from A-E minimum contribution at state pension age Fund needed on top of state pension to maintain lifestyle in retirement Gap in savings at state pension age Extra % contribution on top of A-E min needed to plug the gap Initial extra monthly contribution from take-home pay on top of A-E min needed to plug the gap

Steven Cameron, Pensions Director at Aegon, comments: “Maintaining your ‘working age’ lifestyle throughout retirement is something many people aspire to but for most employees, saving just the required minimum levels for auto enrolment won’t deliver. An employee earning £20,000, for example, should be aiming for a retirement income of around £14,000 per year in today’s money terms to maintain living standards. The state pension and the fund from paying minimum auto-enrolment contributions into a workplace pension will provide a significant proportion of this, but there will still be a considerable fund shortfall of £54,800 in today’s money.

“To plug this gap, they would need to contribute an extra 4.4% of earnings on top of the 5% personal contribution they are currently required to pay under auto enrolment. For someone aged 25 earning a higher salary of £30,000 per year, their gap is much higher and they would need to contribute an extra 8.6%.

“While this may seem daunting, some employers will ‘match’ any additional employee contributions with an equivalent employer contribution. In addition, the Government grants tax relief on employee contributions. With matching employer contributions and the boost from tax relief, this means a 25-year-old employee earning £20,000 per year, would need to contribute an initial £20 per month from take-home pay to bridge the gap. Earning £30,000 a year, this would be £68 with matching employer contributions.

“The best chance of reaching your retirement goals is to plan ahead and look for ways to save more than the auto-enrolment minimum as early as possible. It can also pay to seek advice to ensure you are on track and have the best investment approach to reach the retirement you aspire to.”

|