The cost of car insurance for a 17-year-old motorist who has just passed their driving test has reached £3,075 on average, according to new research from Compare the Market. This is a substantial £1,071 increase in the typical cost of car insurance for a 17-year-old from last year (£2,004).

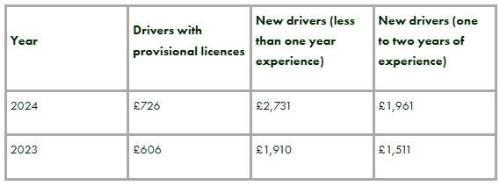

The average cost of car insurance for a driver with a provisional licence (all ages) is £726. This typically increases to £2,731 when a driver passes their test and receives a full licence. Car insurance is more expensive when drivers pass their test as they are no longer being supervised by an experienced driver. However, the cost of car insurance is £771 cheaper after a motorist has earned a year of driving experience.

Compare the Market: Cost of car insurance for new drivers (all ages)

As the cost of car insurance has increased for new drivers, the proportion of young people learning to drive has steadily declined. The latest figures from the Department for Transport show just 27% of 17- to 20-year-olds hold a full driving licence, compared with 37% of 17- to 20-year-olds in 2018.

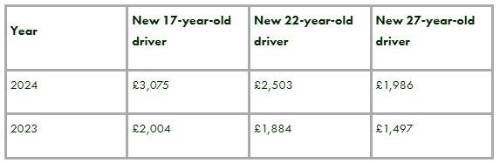

Motorists who decided to learn to drive later in life could benefit from cheaper car insurance. While the average premium for a newly passed 17-year-old is £3,075, this falls to £2,503 for a newly passed 22-year-old. For a newly passed 27-year-old, the average cost of car insurance is £1,089 cheaper, costing on average £1,986.

Compare the Market: Cost of car insurance for new drivers by age

Julie Daniels, Motor Insurance Expert at Compare the Market, said: “The significant increase in the cost of car insurance could make driving prohibitively expensive for lots of teenagers. Newly passed 17-year-olds must now pay more than £3,000 on average for their first year’s car insurance. This will put substantial strain on their or their parents’ finances. However, premiums for new motorists with no claims should then hopefully fall in subsequent years. People should encourage any young drivers they know to look for savings online. Shopping around for a cheaper policy is one of the best ways to try and save money on car insurance.

“As the cost of car insurance continues to increase, it may force some potential young motorists to delay learning to drive. Our research shows that these drivers could benefit from cheaper premiums if they decide to learn in their twenties instead. For those eager to get on the road sooner, choosing a telematics policy may be a good option for some young motorists, whose premium could be reduced if they demonstrate they are a safe driver.”

|