The ACA survey, which was conducted over the summer and received responses from 466 employers, found:

Amongst those with defined benefit schemes (39% of sample)

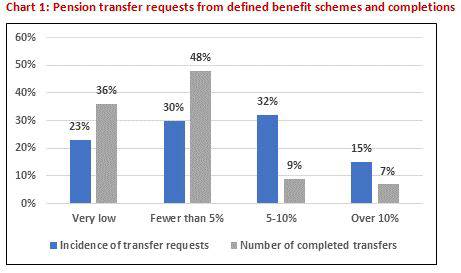

47% say the incidence of transfer requests exceeds 5% of scheme members, with a third of these employers reporting requests exceeding 10% of scheme members

However, completed transfers are at a lower level. Just 16% report completed requests exceeding 5% of scheme members

61% of employers say members are having difficulty in finding advisers prepared to advise on pension transfers

Over the last two years, it has been reported that over £50 billion has been withdrawn from defined benefit schemes, with average transfers out of DB schemes now exceeding £250,000. The ACA’s findings underscore mounting concerns that high transfer values (due to low interest rates) are stimulating member interest in cashing in DB pensions. The flames are being further fuelled by concerns over scheme deficits. Recent publicity suggested three million of the UK’s defined benefit scheme members may only have a 50:50 chance of receiving full benefits.

ACA Chairman, Bob Scott, commented: There are concerns about both the availability and appropriateness of the regulated advice available to DB scheme members. Other research suggests that only around half of those who took advice to transfer were properly advised. Of the other half, one third of recommendations were unsuitable and the remainder were unclear.

“This is disappointing but isn’t surprising. DB pensions are complex and varied and their value is not well understood. Comparing a DB pension to uncertain post-transfer investment returns and income choices is fiendishly complex.

“Our survey results confirm the ongoing shortage of IFAs prepared to provide guidance services in this complex area. However, many schemes are additionally noting to our members that where IFAs are providing advice, the questions they pose during the transfer process are varied and time consuming. The quantum of enquiries and differences in approaches is posing difficulties for administrators and pushing up administration costs. Standardisation in the questions asked would seem to be a sensible step and this may be an area where the FCA could act swiftly to help all concerned.”

Further Interim Reports on the survey’s findings are due to be published and a final report in November.

|