• The Committee is right to be concerned about those approaching State Pension Age (SPA) and the uncertainty they face around how much State pension they will receive

• But it’s not just an issue for those approaching SPA – it’s vital that everyone is made aware of how much State pension they will be entitled to encourage greater saving

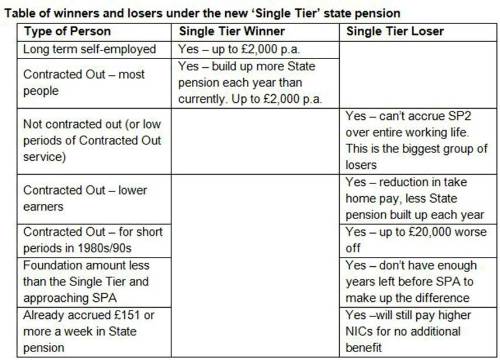

• Of the 31m workers in the UK, over 20m are likely to be worse off due to the introduction of the ‘Single Tier’ State pension – by a conservative estimate of £1,000 p.a. on average

• Those who will benefit are around 5m who are self-employed and around 5m that work in the public sector

• The real losers are employees in the private sector with low periods of contracted out service – which is the vast majority of workers - and particularly those who earn below £15,000 p.a.

• The Government itself estimates an £8bn saving from the introduction to the flat rate* – workers will need to make up this shortfall

• Yet two thirds of workers are not saving enough for retirement**, so reliance on the State pension will increase in the future, heightening the need for clearer communications around reduced State benefits

Commenting, Chris Noon, Partner at Hymans Robertson, said:

“It’s really important to raise awareness of the impact the new State pension will have on individuals so that they seek to understand what pension they be entitled to from the State - rather than being disappointed when they find out it’s not £155 a week.

“While trying to simplify the State pension was commendable, the changes have been rushed instead of being undertaken carefully in phases, for example over three, five or 10 years. This has thrown up anomalies where different groups of people are being treated unfairly. While there will be around 10m winners – including women who take career breaks and self-employed workers - the fact remains over double that number will lose out.

“The Committee is right to be concerned about people who are close to retirement and the uncertainty they face. The picture is incredibly complicated due to the way in which entitlements are worked out. There is a huge transition issue.

“However, there is a much bigger group of losers – employees in the private sector with low periods of contracted out service, which make up the majority, and particularly those earning below £15,000 per annum.”

Explaining why most people lose out, he said:

“The removal of additional State pension (S2P) is the reason most will be worse off. Under the current regime, although basic state pension accrual is limited to 30 years, additional State pension can be accrued over an entire working life (potentially up to 50 years). Under the new system it will be capped at 35 years with no additional State pension so there will be less scope to build up a more generous entitlement.”

“The only people who won’t lose over the long-term are those who don’t accrue additional State pension at the moment. Typically these are the self-employed who are not entitled to additional State pension and employees who are currently contracted out, who are mostly public sector workers. Generally they will receive a higher State pension from the new system.”

Discussing measures to Committee should consider, he added:

“Unfortunately two thirds of people are not saving enough for retirement, so reliance on the State pension is going to increase in the future. This is in the context of less generous State benefits for the majority. Being clearer on the reality of State provision, as well as having a long-term plan from Government around pensions with a commitment to stop tinkering with the system, would encourage greater saving.

“Last month we undertook research that showed that less than a quarter of the UK workforce feel in control of their pensions generally. When asked why they don’t feel in control, 64% said they don’t know what income they’ll get when they retire and 48% said it’s because the system changes too much.

“When asked what would make them feel more in control, 39% said a long-term plan for pensions from the Government, 39% said fewer changes to pensions by the Government and 34% said clearer communications from Government in relation to their pension. 68% of workers we surveyed said fewer changes to the pension system would encourage them to save more.

“The FCA’s initiative to create a pensions dashboard whereby all of an individual’s pension saving, including State and workplace savings, can be viewed in one place, would be a step in the right direction. A genuine long-term plan for pensions and a commitment to stick to it would be even more welcome.”

*Government’s Green Paper “The single-tier pension: a simple foundation for saving” January 2013

**based on an analysis of 400,000 DC savers through Hymans Robertson’s Guided Outcomes (GO™) DC solution

|