Michael Stefan, Partner at Hanover Search Group

Incidentally, for anyone interested, the original article can be found here (https://goo.gl/Ri3ZAd), and I was particularly intrigued to see the "data science" question also come up at the UK Institute and Faculty of actuaries ("IFoA") annual general insurance conference in Dublin last week (nicknamed "GIRO").

My original intention was to answer this question using two perspectives: the ease of finding a new role (as measured by "supply of talent" versus the "demand for talent") as well as salaries on offer. I also felt it would be important to cover a number of geographies, and my initial thought was to include the UK, USA, India, Canada, Germany, Switzerland, Singapore and China. That said, it rapidly became apparent that the salary issue was going to be very difficult to unpick - once you find a reliable salary survey, you have to adjust for exchange rate, income tax (which varies from state to state in the US), cost of living etc. So, at the risk of (over) simplifying, I decided to concentrate on answering one simple question: given a professional working in either the "actuarial" or "data science" fields, how much competition do they have for each job that comes up? I looked at the three largest markets - UK, USA and India, as I felt covering 7-10 countries would run the risk of making the analysis too cumbersome.

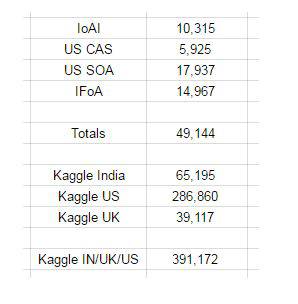

First of all, we need to figure out the total candidate pool for both professions, starting with the actuarial field. I'm going to ignore the fact that a small number of actuaries can also double up as data scientists as it does not meaningfully impact on the numbers. The good thing about a "formalised" profession like actuarial science is that membership information is relatively easy to obtain. As a reminder, the majority of actuaries in the UK are members of the IFoA, and the majority of actuaries in India are members of the Institute of Actuaries India ("IoAI") whilst actuaries in the USA are either members of the Society of Actuaries ("SOA") if they are life and pensions actuaries, and the Casualty Actuarial Society ("CAS") if they are general insurance actuaries. Again, I will simplify things somewhat by ignoring the small number of actuaries can be members of more than one profession or the very small number of US general insurance actuaries doing SOA exams. I am using the term "actuary" to include both credentialed actuaries who have reached the Associate/Fellow designation, as well as "student" actuaries who are considered "active" by their national society.

So, what do the numbers look like? The most helpful membership study came from the IoAI 2014-15 annual report (http://goo.gl/Dusvgs) which gives a grand total of 10,315 members as of 31st of March 2015 (and I would expect virtually all of them to be based in India). The IFoA membership report (http://goo.gl/qYgQ5Z) as of December 2014 shows 26,762 members, though only 56% of them are UK based. CAS does not have a 2015 report out yet, but it did have reports for 2013 and 2014 (https://goo.gl/Nqni48). In 2013, there were 5131 CAS members in the US, rising to 5,503 in 2014, a growth rate of 7.66%. Using the same growth rate would give us an estimate of 5,925 for 2015. Lastly, the SOA has just published it's 2015 annual report, with 26,515 members, of which 17,937 are US based.

Having looked at the size of the actuarial candidate pool, I decided to try to estimate the size of the "data science" pool. Here we have the first major problem - there is no such thing as an official "data science" society. Indeed, it's actually quite hard to define a "data scientist" with the same rigour as defining an actuary so I decided to tackle the problem by using two sources and comparing results: LinkedIn and Kaggle.

Linkedin, for better or for worse, has become ubiquitous within the professional, knowledge intensive economy. Having recruited people before it became popular, I'm certainly mindful that "not everyone is on LinkedIn" but it does provide us with a start. My problem with Linkedin is that there is no such thing as a standard data scientist job title, with a number of people who could be considered "data scientists" working in a wide range of industries, each with its' own taxonomy. For example, search for "machine learning" and you get nearly twice as many results as "data scientist". Kaggle, on the other hand, markets itself as "Home of Data Science" and to me it feels like the "go-to" place for "data scientists", with a number of competitions (some with very high value prizes) for people to showcase their skills. Interestingly, Kaggle will also sell you a job posting and as part of their "pitch" they claim to have over 650,000 data scientists (the following screenshot was taken on Mon 26th of Sept)

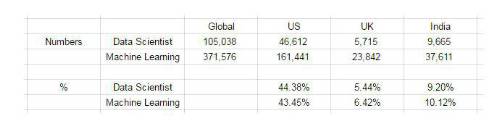

Not all of those members will be currently working within "data science" of course (I suspect many are looking to enter the field) and of course not all of those will be in the US (more on that later). Since Kaggle doesn't provide a breakdown of where these data scientists are based, I decided to do my estimation using LinkedIn to work out approximate ratios for "data scientists" residing in the US, UK and India as a percentage of the total global population.

In other words, roughly 44-45% of LinkedIn "data scientist" profiles are in the US, with 5-6% in the UK and 9-10% in India. I would expect these numbers to change over time - indeed, when I first performed this analysis at the end of August, Kaggle claimed "only" 630,000 or so members, meaning it has added over 20,000 in the last 3 weeks (pretty stunning if I'm honest and at this rate they should reach 700,000 by the end of 2016). I would also expect LinkedIn to have higher numbers over time, but there is no reason to think that the geographic distribution percentages will change much.

So, as a rough estimate, 44% of Kagglers will be in the US, 6% in the UK and 10% in India, meaning we now have the following (very rough) estimate of the total actuarial and data science candidate pools.

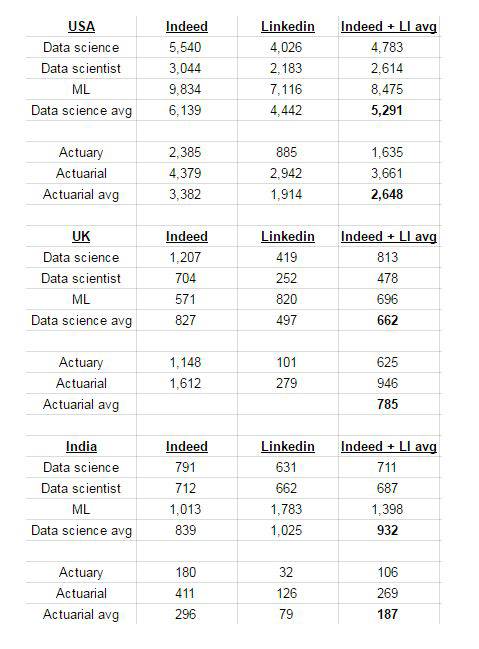

So, we now know the "supply" side of our equation (the total size of the candidate pool) and it's time to estimate the "demand" side (ie how many publicly-advertised jobs we can find). Annoyingly, Kaggle only shows "featured" posts so I looked for open jobs posted on LinkedIn and Indeed. I did consider using Glassdoor too but their results didn't seem to be very consistent, and I also ignored job postings on the IFoA, SOA and CAS job boards as I wanted to have a consistent approach. I performed 5 searches - 3 for data science ("data science", "data scientist" and "machine learning") and 2 for actuarial ("actuary" and "actuarial"). The results are summarised below. Again, as new jobs are being posted all the time (and old ones being taken off), I would expect the numbers to change slightly over time.

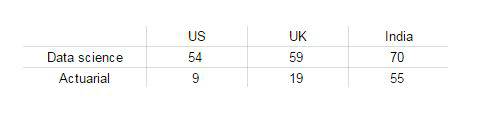

Last but not least, we combine the "supply side" (candidate pool, ie total number of professionals, either known or estimated) with the "demand side" (average open jobs) and we can estimate the "competitiveness" of each field.

In other words: if you are a "data scientist" in the USA, for every job advertised there are 54 potential total applicants, 59 in the UK and 70 in India. If you are an actuary, the competition seems less fierce with 9 potential applicants per job in the US, 19 in the UK and 55 in India.

Of course, just because there X number of total professionals working in a field doesn't mean they will ALL be looking for a job; but if we take the old recruitment "rule of thumb" that 10% of the professionals in any field are openly looking at any one time, the disparity between the two will be just as high (5.4 potential applicants per job in the US data science field compared with just 0.9 actuaries). I appreciate that many of the figures above are just estimates but absent other data sources, it's the best that I could find. One possible explanation for the disparity is that barriers to entry to the actuarial profession are higher (membership fees, the requirement to do exams and then continue accumulating CPD points etc etc). I would imagine a lot of training in data science is "self taught" as opposed to an exam based system and some may say that it makes for a more accessible profession.

How confident am I in my findings? I'm pretty confident that the number I've estimated for the total of CAS actuaries is pretty close to the mark. I'm not that confident in my estimate of the TOTAL number of data scientists although I reckon my estimate of the geographical distribution is probably right. And I'd love to know if data scientists out there have other job boards/portals that they use on a regular basis. I have also not performed a detailed geographical analysis (eg comparing the East Coast of the US vs Silicon Valley) but that's beyond the scope of this article.

So, if I was asked: "I'm an actuary, should I be a data scientist?", I would probably suggest the answer should be "no", at least from a high level, industry wide perspective. All else being equal, I would far rather be part of a smaller candidate pool; that should hopefully give me higher visibility. I was also really surprised by how much the "counter" for "data scientists" increased on Kaggle between my first draft (end of August) and my publication (end of September). I'm not sure how I would feel about my career options in a field with 20,000 new entrants a month.

Before I go, I wish to leave the reader with some further thoughts:

Silicon Valley probably offers way more data science opportunities than it does actuarial ones, so I would imagine the demand/supply ratios will be far nearer to each other than at an aggregated US level

There doesn't seem to be much difference in the demand/supply ratio in India, and I would imagine that the competition level for pre-Fellow actuarial jobs is broadly similar to competition for data science jobs; there are very few Fellows in India compared to the overall actuarial population and so Fellowship there confers a certain level of prestige that's hard to match in other industries

My analysis ignores the "intellectual challenge" aspect of work which is a key component that many people will say they consider. For all the efforts of major actuarial professional bodies, the vast majority of actuaries still work in traditional domains (life/health, pensions/annuities, general insurance) and if you are looking for a challenge outside of these fields, then becoming a data scientist will certainly stretch you

If you are a particularly technical actuary, there is no reason why you couldn't add some data science skills to your portfolio; after all, if you can have both the technical skills (computing, stats) as well as the credential (Fellowship), then some would see that as an ideal way to "future proof" your career

Being part of a small exclusive profession doesn't mean career opportunities will be around forever; I imagine the number of vacancies for abacus users is very small compared to 2000 years ago

Last but not least, it's worth remembering that the two professions can (and should) work together, especially in the industries that employ both (insurance and pensions). My analysis here was something that I have wanted to do for some time, if only to put some numerical context around the trends/discussions that I see on LinkedIn. I would greatly welcome any comments, especially from data scientists, and even more so if someone can suggest a more accurate estimation for either the supply of talent or the demand (jobs).

|