By Alex White, Head of ALM Research at Redington

This means that, through time, the asset duration will need to be extended. Therefore, in practice, holdings are often more like indices with a steady cashflow profile than ‘run-off’ assets with a declining cashflow profile.

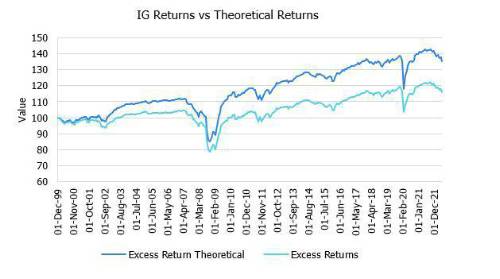

The issue, then, is that the returns aren’t quite as predictable. The chart below shows excess returns of the US corporate bond index to June 2022, alongside theoretical excess returns (‘predicted’ by spreads and spread moves) accounting for spread, duration and convexity through time. The excess returns have been 0.7%, while theoretical returns would have been 1.4%. Defaults have been low over the period and do not explain the gap.

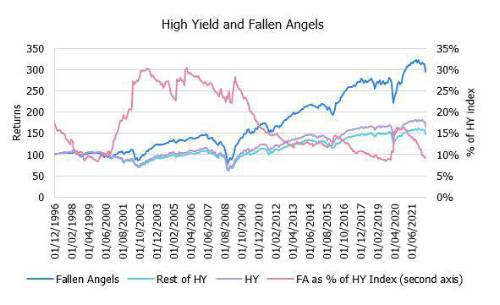

A large part of the explanation comes from fallen angels. When an issuer ceases to be investment grade (IG), it falls out of the index. Passive investors and investors with tight high yield limits (including insurers with capital constraints) have to sell the bonds. Even though the probability of default is still low, the bonds are sold at wide spreads, meaningfully hurting corporate bond returns.

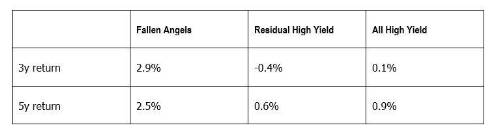

The corollary to this is that fallen angels should offer excellent value, and in general this is backed up by history. Not only have they outperformed, they have materially outperformed the rest of the high yield market. Since 1996, they have delivered excess returns of 4.2%, while high yield more broadly has returned 2%, and the residual high yield index only 1.5% (all have had similar volatilities of 10-11%). Despite only averaging 17% of the high yield index, fallen angels have accounted for roughly half of high yield returns.

The markets are not blind to this, and it is now typical for IG mandates to have a wider buffer of, say, 10% in high yield, precisely to mitigate this issue. The evidence suggests that this is a meaningful advantage. However, this effect has not disappeared in the last few years, which implies there are still plenty of investors who will sell on a downgrade.

Like any risk premium, there are better and worse implementations. While a passive approach can work, thorough credit analysis on these issuers is likely to be worthwhile. Either way, though, fallen angels can be an effective way to access credit.

|