Halifax Home Insurance received an 18% increase in claims for lost and stolen jewellery between February 2017 and February 2018*.

The insurer received 1,698 claims for lost or stolen jewellery last year, and 1,610 claims in 2017*.

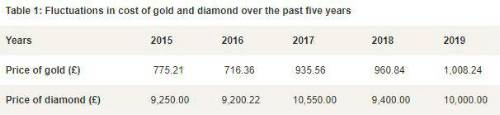

In the UK, the average cost of an engagement ring is £1,5001. Over the past five years, the price of diamonds has increased by 10% [see table 1] and the cost of gold has also increased by 30% [see table 1].

With Valentine’s Day fast approaching, many people will be nervously preparing to pop the most important question of their lives: ‘will you marry me?’ However, before thinking about wedding planning, couples are reminded to think about insuring their engagement ring.

David Rochester, Head of Underwriting, Halifax Home Insurance, said: “For newly-engaged couples, engagement rings have both emotional and financial value. It is important that you have insurance in place.

“Making sure you have the right level of insurance means that newly-engaged couples can enjoy wearing their ring, knowing that they are properly protected.”

The ultimate vows to ensure your ring is protected:

To honour and protect: ensure you tell your insurer about your high value item so that your ring is protected, and keep valuation certificates or receipts in case you need to claim

To have and to hold: have a think about whether you need to take out additional cover to ensure you always have your most precious items covered both in and away from your home

For better, for worse: don’t leave your jewellery in conspicuous places such as on windowsills which can be easily reached by burglars

To love and cherish: make sure you cherish your ring by keeping it safe, either in a safe or locked cabinet and avoid ‘safe’ places such as under the bed or in bedside drawers – these are the first places burglars look

I make this vow: seal the deal by taking photographs of your valuable items as this can help insurers to process a claim more easily, or to help have the item re-created

Lynn Tones, Fellow of the NAJ’s Institute of Registered Valuers, Aurum Jewellers, said: “The price of precious metals and stones fluctuates over the years, so it’s important to have your jewellery valued every two to three years by a professional accredited valuer.

“Over the last five years, many will be surprised to find out that the price of their wedding band increased significantly therefore it is important to have an expert to provide an accurate value of your jewellery.”

|