By Roger Gascoigne is a Senior Director and Derek Ryan is a Global Consulting Lead for IFRS 17 Life business at Willis Towers Watson By Roger Gascoigne is a Senior Director and Derek Ryan is a Global Consulting Lead for IFRS 17 Life business at Willis Towers Watson

As insurers are fast discovering, the intricacies and complexities of IFRS 17 multiply rapidly once you start getting into the details of calculations and presentation. The selection of options, the use of judgement in applying a principles-based approach, and the need to deal with amendments and emerging guidance all result in a complex methodological labyrinth of twists and turns.

From methodology to implementation to reporting; from people to processes to technology; insurers will need the right breadth and depth of expertise and technology to steer their way through the maze of different workstreams.

Figure 1. A view of the IFRS 17 challenge. Where are you on the journey?

Despite the complexity and the work involved to be IFRS 17-ready, insurers will benefit from putting the challenge in a broader context and approach IFRS 17 as a wider business improvement project. One that can add value to the business.

Insurers should aim to have a complete end-to-end solution that delivers automation, efficiency and auditability ‘out of the box’, saving time and money and allowing experts to be deployed on higher value tasks. Insurers’ risk, actuarial and finance functions will then be able to do more, faster and with less.

Applying lessons learned

Simply complying with IFRS 17 brings many challenges, which often carry significant business implications. But fresh from the recent experience that most insurers have had in implementing regulatory change, it also brings some familiar ones. For example, the need to produce numbers and analyses ever quicker, with greater transparency, and with more stringent governance and controls.

The IFRS 17 engine

IFRS 17 is an accounting standard, but many of the principles are closer to a typical actuarial model than a traditional accounting model. Moreover, the CSM calculation uses both forward-looking information that typically comes from an actuarial model and backward-looking actual experience that usually comes from an accounting system.

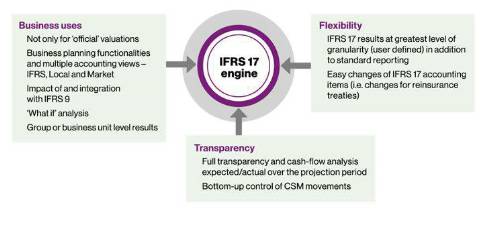

An IFRS 17 implementation solution that has the CSM calculation in the actuarial system is therefore likely to be the most cost-effective and process-efficient approach. In addition to enabling companies to use current assumptions, functionality and to maintain consistency, there are three key reasons to locate the CSM calculation engine close to the cash flow projection models: business uses, flexibility, and transparency.

Figure 2.The IFRS 17 engine

A holistic approach

Historically in insurance, system and process evolution has often taken place in a piecemeal fashion, in isolation from other business considerations. For many, the default approach has been to extend legacy platforms and add to a suite of spreadsheets to perform additional functions. Over time, they become slower and put greater emphasis on often manual housekeeping activities.

IFRS 17 will inevitably heap further pressure on insurers to deliver additional numbers and analysis within tight timeframes and with the requisite audit and governance.

At the same time, for insurers that decide to look beyond compliance, this might represent a once-in-a-generation opportunity to take a step back and take a more holistic view of their processes and systems; to assess the use of Robotic Process Automation to control calculations and introduce better governance and controls; to explore Cloud Computing to enable cost-effective scaling up and down of computing power to meet peak demands; and to release expensive actuarial resource from mundane tasks to focus on where they can add real value for the business.

Many decisions concerning IFRS 17 implementation need to be made now and if we are to learn lessons from Solvency II, implementation of these regulatory requirements is going to be costly. It is therefore crucial that insurers take prompt action that combines the holistic perspective necessary to realise the many benefits that go beyond IFRS 17 compliance.

|

By Roger Gascoigne is a Senior Director and Derek Ryan is a Global Consulting Lead for IFRS 17 Life business at Willis Towers Watson

By Roger Gascoigne is a Senior Director and Derek Ryan is a Global Consulting Lead for IFRS 17 Life business at Willis Towers Watson