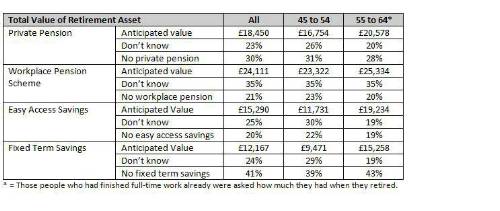

When asked how much they anticipate their entire workplace pension scheme might be worth when they retired, 35% of people aged 45 to 64 said they did not know and 21% admitted they did not have anything at all. This age group also showed worrying levels of ignorance around the full value of other typical retirement assets such as their private pension (23%), easy access savings (25%) and fixed term savings (24%).

While you might anticipate that people who had ten-years or less until traditional retirement age may have a better understanding of their assets, 35% of 55-64s did not know how much their workplace pension was worth and 20% were unaware of their private pension’s total value.

While some may be saving for retirement but have little understanding of the value of these savings, others have yet to make this type of preparation. Worryingly, 28% of 55 to 64s have no private pension and 20% have no workplace pension which suggests that some people will be heavily reliant on the state pension.

Andrew Megson, Managing Director of Retirement, Partnership, said,

“Planning for the various retirement eventualities is hard enough when you know exactly how much you do have but it is likely to be almost impossible if you don’t even know that! While it may take a little time, getting a better understanding of the value of your total assets will allow you to take practical steps to improve your retirement before it is too late. Lack of preparation can mean that people’s choices are restricted and they may need to make some very difficult decisions at retirement.

”The new pension freedoms are about providing people with far more choice than before and we are delighted to support peoples’ aspirations with the launch of our Enhanced Retirement Account. This SIPP contains a flexi-access drawdown account offering a choice of investment funds and a cash account combined with the guaranteed income of an enhanced annuity. Designed to grow and change with customers’ individual needs, this will help people to build the retirement that they want.”

|