Andrew Tully, technical director at Canada Life comments: “The nil rate band for Inheritance Tax has been frozen for more than a decade and as a result is woefully lagging behind inflation. While IHT has historically been a tax of the very wealthy this is clearly no longer the case. With property prices soaring and most personal tax allowances including the standard and residence nil rate band frozen until April 2026 , this is now a concern for larger sections of society as the IHT tax net widens.

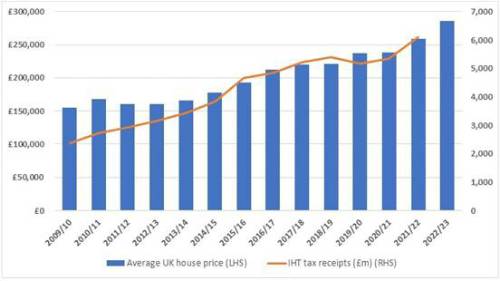

“IHT is a very valuable tax for HMRC, delivering £6.1 billion to the taxman in 2021/22, £729 million more than the previous year. With the OBR predicting this will continue growing to an incredible £8.3bn by 2026. This year’s surge in income will partly be driven by the ongoing increase in house prices, as residential property makes up the largest share of most estates. There has also been a higher volume of wealth transfers due to Covid – partly due to more deaths in the elderly population, but also as some people make outright gifts to help family during this difficult period.

“There is a considerable amount of planning which can reduce IHT bills. These include setting up a trust, making full use of gift allowances which allow you to pass on money to family while reducing your estate, and making a will and leaving a legacy to charity. Pensions are also normally excluded from your estate for IHT purposes. You can potentially pass on your pension in a tax-efficient way so take this into account when deciding which assets you use to provide an income in later life. Expert advice will be able to understand your specific situation and make the most appropriate recommendation for you and your loved ones.”

The connection to property prices

- The average cost of UK property, the main asset for many people, has significantly outstripped inflation at a time when the IHT nil rate band will have been frozen for at least 17 years by the time we get to April 2026

- The average cost of a UK property in June 2022 was £294,845 – the comparable figure for April 2009 was £154,716

- The residence nil rate band was introduced in 2017 and allows potentially a further £175,000 to be used against the main residence if left to a direct descendant. Estates over £2m will see the RNRB reduced. However this doesn’t necessarily help all clients

Graph showing the strong correlation between increase in IHT receipts and rise in house prices – introduction of residence nil rate band in 2017 helped a little but receipts still on upward trajectory

|