By Amanda Latham, Associate and Policy & Strategy Lead and Pete Smith, Principal and Senior Investment Consultant at Barnett Waddingham By Amanda Latham, Associate and Policy & Strategy Lead and Pete Smith, Principal and Senior Investment Consultant at Barnett Waddingham

At the same time, companies create – even if unintentionally – negative impacts on society or the environment, like pollution, child labour, bribes and corruption, habitat destruction, resource depletion and carbon emissions that cause climate change.

Sustainability presents system-wide risks to the real world and to the markets that you operate and invest in, like climate change, inequality and biodiversity destruction.

To solve these issues, investors can direct capital towards achieving positive social and environmental outcomes. However, impact investing is distinct from giving grants and philanthropy, as impact investors are looking for opportunities to get ahead of changing policies and consumption patterns to achieve financial returns. They are looking to create social and environmental impacts at the same time as achieving, at least, the desired risk/return characteristics for their investment strategy.

Impact adds a third dimension to investor considerations, alongside risk and return. Impact investors actively and deliberately set out to achieve measurable improvements in ESG outcomes. They direct capital toward the solutions to environmental and social challenges, looking for market rate returns on those investments.

"Impact investments are made with the intention to generate positive, measurable social and environmental impact alongside a financial return." Global Impact Investing Network (GIIN)

ESG integration and impact investing strategies have been gaining traction among investors since 2016, according to the Global Sustainable Investment Alliance 2020 annual sustainability report. However, the overall proportion of impact investing remains low despite great potential, and so presents huge opportunities for investors to step in.

Opportunities to have an impact

Impact investing is a growing area for institutional investors. It creates opportunities for investors who are early adopters and get ahead of the building of social changes coming from systemic and existential threats like climate change, biodiversity loss, and increasing social inequality. When you’re thinking about developing your impact investment strategy, you need to:

Focus on doing a few things well and be clear on the outcomes you want to target.

Understand the approach and alignment of your advisers – how will they help you to have the impact that you want to have?

Monitor and evaluate – are your objectives being met? Are your managers engaging and driving long-term value alongside positive impacts?

Impact investment ideas

Place-based investments

Our first client invested in place-based impact investments in 2019. Since then, the market has developed in response to the attractive qualities the sector has for institutional investors. Property has been considered a good investment proposition for a long time, as the asset class has continued to offer relatively stable income, capital appreciation benefits and diversification from other asset classes. Institutional investors have historically gained their property exposure through commercial property, but more recently we have accommodated affordable housing into investors’ portfolios.

The business case for affordable housing

When we discussed this with our client, it was agreed that the fundamental case for investing in affordable housing was attractive due to:

low or negative correlation with equities, bonds and other property sectors

lower drawdowns and faster recovery in economic downturns

attractive net initial rental yields, typically ranging between 3-4%

chronic undersupply and increasing demand for housing

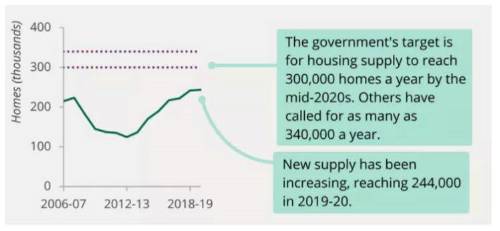

The outlook for affordable housing remains favourable. Every year, there is a significant shortfall in new builds and there are no signs of this being solved in the short term. The government is attempting to solve this housing crisis by encouraging private investment into the sector through various subsidies and grants, which makes investing in the sector even more attractive.

Housing supply

Source: House of Commons Library

Where is the impact?

A benefit of the institutionalisation of affordable housing is the delivery of greater environmental and social benefits over time, directly contributing to the UN’s Sustainable Development Goals (SDGs). Fund managers will either invest in and/or develop modern housing stock that is additive, i.e. increases the supply, ensuring access to affordable, high-quality housing where needed. It will increase financial wellbeing through reduced housing costs and the associated increase in occupants’ disposable incomes.

Our client achieved access to a long-term stream of inflation-linked cashflows to help meet their liquidity needs, whilst simultaneously meeting the goals contained in their ESG policy.

Advising you on impact

When looking for partners to develop and implement your impact investing strategy, you need to consider your advisers and asset or fiduciary managers in terms of their impact investing credentials. Review their competence and experience, how they can align with your scheme’s impact beliefs, and their capacity to help you develop and deliver on your scheme’s impact objectives:

Do they offer bespoke advice designed for your scheme?

What about their research capabilities and their experience?

Can they help you make the impact you want to make?

You should look for advisers who can help you understand where you can have influence and achieve the impacts and returns you want to generate. They need to get a clear understanding of where you want to make that impact and what aspects of it will drive the returns. Your adviser needs to be able to help you develop and implement this thinking.

|