Although the pandemic has resulted in more than 100,000 additional deaths in England and Wales than might have otherwise been predicted, the direct impact on scheme liabilities is likely to be small, with a c.1% reduction in liabilities. These additional deaths will be reflected in scheme liabilities when post-pandemic valuation data is used. Trustees will likely not need to make an allowance in their assumptions to take account of these deaths. Although the pandemic has resulted in more than 100,000 additional deaths in England and Wales than might have otherwise been predicted, the direct impact on scheme liabilities is likely to be small, with a c.1% reduction in liabilities. These additional deaths will be reflected in scheme liabilities when post-pandemic valuation data is used. Trustees will likely not need to make an allowance in their assumptions to take account of these deaths.

Instead, schemes need to consider the potential medium-term impact on longevity and how this is reflected in the mortality assumptions used to value the pension scheme’s liabilities. The unpredictability over the next five to ten years is down to a number of socio-economic factors that will positively or negatively influence life expectancies.

What are bulk annuity insurers doing?

This uncertainty has certainly influenced views on bulk annuity pricing and, as a result, the expected period to buyout for schemes could be affected. The ultimate impact on the pandemic on a scheme’s term to buying out will depend on how insurers respond and in turn adjust their pricing. Typically, insurers are more cautious than a pension scheme when considering assumptions which result in material changes to their liabilities, especially if they are likely to be reduced. This may mean any meaningful change in pricing will not be immediately obvious as insurers digest the emerging data and seek to price accordingly. However, the bulk annuity market is just that: a market. Like any other it is influenced by demand and supply dynamics and competition and hence their pricing will need to stay in line with pension scheme expectations to ensure they can continue to write sufficient business.

Simon Bramwell, Principal and Head of Longevity Risk Transactions at BW, said: “In times of heightened uncertainty like this, it should reinforce the level of volatility and financial risk that pension schemes are exposed to. For many, longevity risk remains mostly unhedged and now should be a time for schemes to assess. With this elevated uncertainty likely to be around for some years to come, this may be a better time than any to remove this unrewarded risk and focus on certainty around reaching the scheme’s endgame.

“The key for those considering a bulk annuity is to monitor the market and ensure their view of pricing is up-to-date and is being assessed relative to a sensible benchmark and that all factors are considered.”

Factors that could impact life expectancies

Factors leading to increased life expectancies

- The pandemic may have resulted in those with poor health dying earlier than expected. In this case population mortality will be lower than otherwise would have been over the next few years.

- The vaccination programme appears to significantly reduce the number of direct virus deaths.

Factors leading to reduced life expectancies

- The possibility of a rise in Covid-19 related deaths following the restrictions being lifted.

- The possibility of a vaccine resistant strain of Covid-19

- During lockdown there was a fall in healthcare for non-essential health conditions and a decline in cancer screenings. This could result in an increase in deaths due to later diagnosis of certain conditions.

- The virus could lead to long-term health conditions such as organ damage and long-Covid.

- The ongoing economic impact of the pandemic, where the possibility of future austerity measures to claw back public spending through the pandemic and a rise in living costs reduce standards of living across the country.

Factors that could lead to either reduced or increased life expectancies

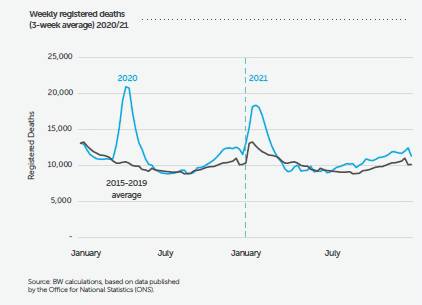

- Pre-Covid the winter influenza season typically drove the overall variability of deaths in a year. However, flu has been largely absent over the winters of 2020/21 and 2021/22 and there’s considerable uncertainty about how the combined impact of Covid-19 and flu will influence mortality in the shorter term.

|