Dean Butler, Managing Director for Retail Direct at Standard Life, part of Phoenix Group said: “Reports of delays to the government’s plans to provide 15 hours per week free childcare to working parents of two year olds will disappoint eligible people hoping for some financial support from April, and worry those set to benefit from the further extensions of the scheme in the September of this year and next – particularly as many will have factored this into their financial plans against a backdrop of rising prices and higher interest rates. Childcare costs can be equivalent to a second mortgage, and for many make the prospect of the household’s lower earner returning to work unjustifiable, without wider family support. This leaves households dependent on one income, squeezing their standard of living and limiting their availability to save for a ‘rainy day’ or the longer-term.

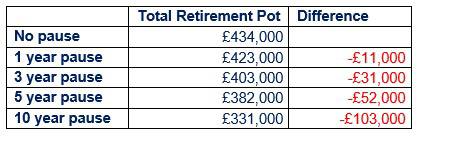

“The person giving up work to focus on childcare doesn’t just lose out on monthly income, but could also face consequences in later life. Our analysis found that someone pausing their pension contributions for five years at the age of 30 due to giving up work could lose out on £52,00 in retirement, not adjusted for inflation. Someone pausing for ten years could lose out on £103,000. More often than not it’s women who give up their jobs, increasing the ‘gender pension gap’. Hopefully any delays to this much-needed scheme will be minimal.”

Impact of pausing pension contributions on overall retirement pots

*Based on pausing pension contributions at the age of 30, if beginning working with a salary of £25,000 per year and paying 5% employee and 3% employer monthly contributions into a workplace pension at the age of 22 and assuming 3.5% salary growth per year, a 1% annual investment cost and 5% investment growth per year. No Earnings Limits applied, and figures not adjusted to take into account inflation.

|