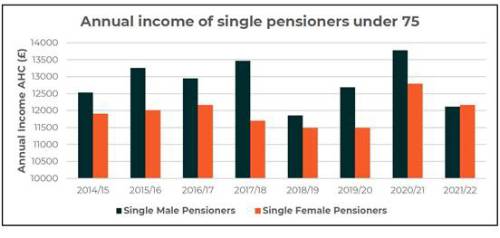

Analysis from Broadstone, a leading independent pension and employee benefits consultancy, reveals that the pension “gender gap” between single pensioners under 75 has reversed.

Data from the DWP shows that women received a greater annual income after housing costs (AHC) than men in 2021/22 – for the first time ever.

In 2021/22, women under 75 received annual income of £12,168, £52 higher than their male counterparts who received £12,116 that year. The gap marks a sharp reversal of the previous years’ data (2020/2021) where the income of male retirees was £988 higher.

The data was not so positive for single female pensioners over the age of 75 who received £2,236 less than the men in their cohort in 2021/22.

Over the past decade, the average annual income gap between this older cohort of single retirees is £1,466 which is nearly double the average annual income gap between younger pensioners (£780).

Damon Hopkins, Head of DC Workplace Savings at Broadstone, said: “On the face of it, the closing of the gender income gap among younger pensioners is good news.

“However, viewing this data in a broader context, it’s clear that there is a high number of people that will not achieve a comfortable standard of living in retirement.

“The PLSA’s minimum retirement living standard is £12,800 for a single pensioner so it is evident that for many pensioners their incomes in retirement are unlikely to be delivering the quality of life that they would have hoped for.

“This is particularly pertinent for single pensioners with other government data showing that single people (19%) are more than twice as likely to not achieve a minimum income standard compared to couples (8%)2.

“Overall, its further evidence of the urgent need for the Government and all stakeholders in the pensions industry to prioritise ratcheting up contribution rates and investment innovation in the years to come. This will be crucial to ensuring both male and female pensioners can build up adequate pension savings.”

|