But against a backdrop of an inflation busting 8.5% state pension triple lock increase this April, the Chancellor could view a cut for those of working age as intergenerationally fair.

Aegon’s Pensions Director Steven Cameron looks at how the numbers stack up: “As speculation swirls around whether the Chancellor will be able to cut income taxes, the odds are on a small cut in the employee National Insurance rate rather than a cut in the basic rate of Income Tax. National Insurance is paid by workers up to state pension age, so cutting it focusses the benefit on this group, perhaps to make sure it pays to work. By contrast, while many state pensioners would benefit from a cut in the Income Tax rate, they won’t gain from a cut in NI as no-one above state pension age pays NI. Some might feel a cut in NI, following the 2% cut in January, means they are missing out again. However, for most, the inflation busting 8.5% increase in state pension from the triple lock could more than compensate.

“The full state pension is increasing by 8.5% this April from £10,600 to £11,502 a year, an increase of £902.40. The current rate of inflation is 4% - so in terms of ‘purchasing power’, state pensioners will be £478 a year better off as a result of the triple lock compared to if their increase had been based on current inflation.

“Individuals who depend entirely on the state pension and do not have private or workplace pensions, or other sources of income, are below the personal allowance of £12,570 so don’t pay Income Tax. However, a significant number of state pensioners receive additional income from private or workplace pensions, as well as other taxable sources alongside their state pension.”

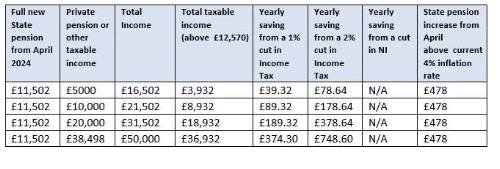

The table below illustrates the amount pensioners would benefit were the Chancellor to announce a cut of 1% or 2% cut in Income Tax:

State pensioner on full new state pension

Steven Cameron continued: “Our analysis shows any state pensioner with an income up to £50,000 a year will see their purchasing power after inflation boosted by more under the state pension triple lock than from a 1% cut in Income Tax. And if workers were granted a 2% tax saving, we calculate the inflation busting triple lock still offers more benefit for state pensioners with incomes up to £36,470.

“So while some state pensioners may be disappointed if the Chancellor cuts NI and not income tax on Wednesday, balancing the books including being fair between generations is particularly challenging. Honouring the state pension triple lock in full is actually more beneficial to most state pensioners.”

|