Phoenix Group, the UK’s largest long-term savings and retirement company, along with WPI Economics have published a new report ‘Falling behind the curve’ which models the cost to individuals and the economy of delaying an increase to minimum auto-enrolment pension contributions, from the current rate of 8% (which includes a 3% employer contribution and 5% employee contribution).

The modelling builds on the recommendations of their 2023 joint report ‘Raising the bar: A framework for increasing auto-enrolment contribution’, which provides a framework for government, outlining the economic conditions to determine when and how the minimum contribution rate should increase to 12%[i].

Cost to individuals

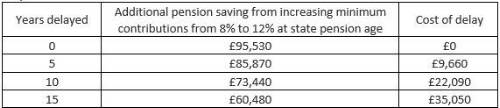

For a typical 18-year-old, increasing minimum auto-enrolment contributions from 8% to 12% could lead to almost £96k extra in their pension pot (in today’s money terms) at state pension age, equivalent to £64/week. However, delaying this increase by 5 years, reduces the total additional savings potential by nearly £10k. A 10-year delay reduces the additional savings potential by around £22k, and a 15-year delay by £35k[ii].

18-year-old on median income

Source: WPI Economics analysis (2024). Values rounded to the nearest £10 in the table, and in today’s money terms.

Cost to the economy

In addition to the benefits for individuals, pension funds are institutional investors with the potential to drive capital into investment opportunities that support the UK economy and net zero targets, while ensuring a continued focus on securing the best outcomes for customers.

The modelling finds that increasing minimum contributions from 8% to 12% will result in total additional pension contributions of £10 billion a year. Assuming a 5% allocation to unlisted equities in line with the Mansion House compact[iii], every 5-year delay to increasing auto enrolment contributions could cost around £2.5bn in investment into unlisted equities. Furthermore, assuming a 23% allocation to UK listed equities, every 5-year delay could cost £11.5bn in investment in UK equities.

Andy Curran, CEO of Standard Life part of Phoenix Group comments: “Millions of UK adults are not saving enough for their future retirement income[iv], so it is crucial we have a plan to support greater pension saving throughout people’s working life. Increasing minimum auto enrolment contributions is fundamental to addressing this challenge, particularly as many people are unengaged with their pension or have low confidence in their pension knowledge[v].

“Alongside the benefits for future retirement incomes, there is a wider economic benefit that pension capital can play in driving investment to sustainable and productive assets, ensuring optimal outcomes for savers remain at the centre of investment decisions. Phoenix Group is a signatory of the Mansion House Compact and supports the opportunity to unlock more pension fund assets to stimulate growth and support progress to net zero whilst also keeping policyholder protection at its core.”

Gail Izat, Managing Director for Workplace Pensions at Standard Life, part of Phoenix Group said: “While the success of auto-enrolment has laid a solid foundation, more needs to be done to help people secure a decent standard of living in retirement. The single biggest lever government can pull to achieve this goal is raising minimum contributions when the time’s right for savers and employers. Long-term savings adequacy underpins the financial wellbeing and security of individuals and could help contribute to the success of the wider economy, while employers also have a lot to gain from a financially stable workforce and the potential additional investment in the UK.

“Without action, we risk exacerbating under-saving for people of working age as they move closer to retirement as well as depriving the economy of a highly significant line of finance. Raising contributions as soon as possible has benefits for all.”

Statutory Requirement

Phoenix Group is calling for a new Statutory Requirement to support long term pensions adequacy, which explores whether auto-enrolment savings levels are achieving decent retirement outcomes and how it interacts with the state pension. This should include an assessment carried out by the Government against economic indicators to decide whether the minimum rate should be raised.

|