Favourable market conditions for pension schemes over February, including an improvement in forecast long-term yields of around 50 basis points, have seen the deficit drop to zero from £120bn at the end of January. The combination of continued cash contributions to repair deficits and evolving forecasts for future unknowns such as inflation and life expectancy has led to a zero deficit for the first time since the Index was introduced in 2014.

PwC’s Adjusted Funding Index incorporates strategic changes available for most pension funds, including a move away from low-yielding gilt investments to higher-return, cash flow generative assets, and a different approach for potential life expectancy improvements which are yet to occur. This measure shows a £180bn surplus.

Raj Mody, partner and head of pensions at PwC, said: “It’s reassuring that UK defined benefit pension schemes have neutralised their deficits in aggregate. This is no surprise given the recent combination of continued deficit repair payments and slightly more favourable market conditions. However, it would be wrong to think the position for pension schemes is now sorted for good. It’s not necessarily the case that the recent improvement in forecast long-term yields is here to stay.

“There’s an urgency now for trustees and sponsors to really understand their own unique situation, and see whether they are in a position to lock in a strong status, instead of running unnecessary risk or requiring more financing. The £180bn surplus on the Adjusted Funding Index shows many schemes have hidden buffers relative to alternative and more transparent measures of their funding status. They could now use these to secure their position, which would help protect members’ benefits, as well as release extra cash from the sponsoring company so it can invest in its business and jobs. That’s a win-win all round, for employees, pension members and scheme trustees.”

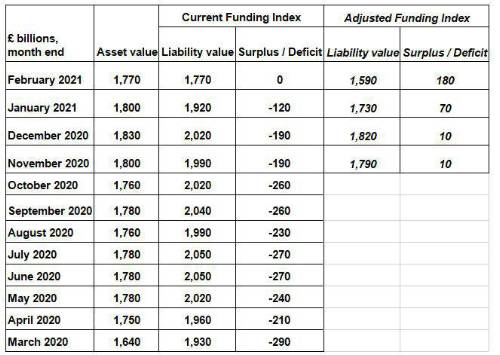

The PwC Pension Funding Index and PwC Adjusted Funding Index figures are as follows:

Raj Mody added: “Sponsors and trustees should make sure there is a mechanism to switch off deficit repair contributions where their schemes are sufficiently well funded. With the Chancellor’s Budget tomorrow expected to focus on continued support for the economy, as well as its recovery, there is a role for pension schemes to play. While it is right that pension schemes are run prudently, it may not be a good time to risk over-funding and trapping money in schemes for decades at a time when the UK economy needs all the investment it can get to ensure a strong and fast recovery.”

|