By Tyrone Potts, FIA, Associate - Head of Pensions Research, Barnett Waddingham

Whilst the resulting definition may not be particularly controversial, all trustees will nevertheless have to assess whether they meet the description TPR has set out for professional trustees. This must be disclosed in their next scheme return (although the Regulator may still decide that a trustee is “professional” based on the facts of any investigation they carry out).

Having a robust definition of a ‘professional trustee’ is deemed necessary because higher expectations and standards are generally applied to professional trustees - and it is no coincidence that TPR has also chosen to publish its Monetary Penalties policy alongside the new definition.

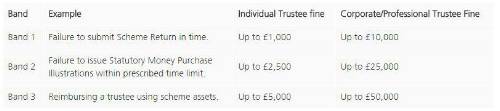

The fines that professional trustees could face are significantly bigger than those for individual trustees – up to ten times greater in some cases. TPR has proposed that, save for a handful of instances that require a specific approach to fines, its monetary penalty framework will comprise three bands:

The resulting penalty will be linked to the severity of the breach and whether the trustee is individually appointed or part of a professional corporate body.

A trustee is not necessarily deemed professional just because they are paid for carrying out the role. TPR would “not normally consider a remunerated trustee to be acting … in the course of the business of being a trustee” where they are / were a member of the scheme or employed by a participating employer, (providing they do not also act as a paid trustee to any unrelated schemes).

Nevertheless, TPR says that even if you are not directly paid (if you are acting pro-bono or are being remunerated in some other way for instance), you could still be considered a professional trustee.

The fact that remuneration does not automatically make a trustee professional will be welcome relief to the many former company secretaries and ex-directors who, in retirement, supplement their income by offering their considerable knowledge as a trustee to the pension scheme – a continued benefit to all scheme stakeholders.

“Lay” trustees with significant experience will also escape being labelled “professional” - the key test will be whether the individual represents or promotes themselves as having “expertise” in trustee matters generally.

When TPR published the original “21st Century Trusteeship…” discussion paper in 2016, they mooted the idea of mandatory qualifications for all trustees, to which the response from the industry was not entirely supportive. Nevertheless, formally identifying trustees to whom higher standards will apply may yet be the first step on a route to requiring that they also hold a recognised qualification.

|