The LCP webinar focused on the DWP’s recently closed consultation on options for DB funding reform and featured contributions from Work and Pensions Committee Chair, Sir Stephen Timms, and LCP’s Sir Steve Webb and Laasya Shekaran. The event was hosted by LCP partner and former policy head at the Pensions Regulator, David Fairs.

In his contribution, Sir Stephen Timms mentioned that the Committee were concerned about whether DB funding rules did enough to allow remaining open schemes to stay open and continue to invest for growth. He also mentioned that, in light of the LDI crisis of last year, the Committee was interested to know if new ‘systemic’ risks could arise if large sums were transferred from DB pension schemes to the buyout market and then invested in a relatively narrow range of assets.

The focus of the event was on the different ways in which the Pension Protection Fund (PPF) could be used to support more productive and higher return investments by DB pension schemes. These ranged from LCP’s proposal, which focuses on the largest and best funded schemes, to the idea of consolidating large numbers of small schemes, advocated by the PPF itself. There was also discussion of the ‘Tony Blair Institute’ proposal for much larger scale consultation into the PPF and other large-scale consolidators, eventually involving everything from the Local Government Pension Scheme to NEST.

During the discussion, the 200 attendees at the event were asked about their priorities in the event that reforms of this sort generated increased surpluses for DB schemes.

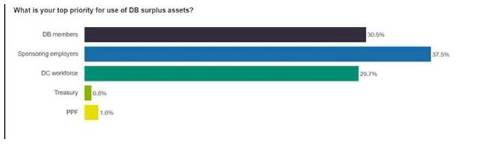

The results showed a roughly even three-way split between the main options as shown:

Source: Votes at LCP webinar held on Monday 4th September 2023

By a narrow margin, the largest group of participants (37.5%) felt that the companies who had set up the scheme in the first place and provided most of the funding should be the ones to benefit most from any upside. But there was also strong support (30.5%) for DB members to see some upside – perhaps from discretionary benefit increases – and for also (29.7%) for the DC generation to benefit from released surpluses. This option is known to be a major priority for Laura Trott, the Pensions Minister.

Commenting, LCP partner David Fairs said: “It is clear from the results of our survey that there is plenty of potential to benefit a wide range of stakeholders if DB surpluses can be grown and shared. If member benefits can be protected in the way we have suggested, the biggest and best DB schemes would be freed up to generate bigger surpluses. There is clearly an appetite for those surpluses to do good across both the sponsoring employers and existing DB members but also to enhance provision for future generations of retirees. We hope that the Government will see the potential for reform and look forward to hearing their conclusions in November’s Autumn Statement”.

|