By Abigail Currie, Head of Member Options and Laura Bird, Director, Retirement at WTW By Abigail Currie, Head of Member Options and Laura Bird, Director, Retirement at WTW

This is also backed up by the Office for National Statistics, which states almost half of UK adults are spending less on non-essentials because of cost-of-living rises.

It’s all down to inflation - the persistent rise in the general price level of goods and services over time. Although there are signs that the rate of increase may have peaked, inflation still remains persistently high.

So what does this mean for defined benefit (DB) pension scheme members and how can you help support your members in these challenging times? You can’t personally reduce the rate of inflation. However, as explained below, you are in a privileged position as a trustee to be able to make a real tangible difference to the lives of your members.

The problem for your members (it’s not a storm in a teacup)

According to the Office for National Statistics, in May 2022 a pint of milk cost 42p. A year later (in May 2023) that same pint of milk costs 70p. That’s an increase of 67%.

Add to this a 14% increase, over the same time period, to the cost of tea bags (don’t get us started on the sugar!) and your average cup of tea is looking quite pricey.

This is (currently) an upward trend across the whole ‘basket of goods’ used to measure inflation. And whilst the Bank of England had hoped that inflation could fall to 5% by the end of 2023, that’s still 3% higher than their target.

Although deferred members typically have full inflation protection before retirement, persistent high inflation is steadily reducing the “purchasing power” of most pensioners’ retirement income. Annual pension increases provide some protection against the impact of rising costs. But when inflation is high this protection is limited – as pension scheme increases are typically capped at 2.5% or 5% a year.

Therefore, trying to consider future cost increases when retiring now is going to be something pension scheme members need to understand and consider.

What can trustees do to support their DB members?

It’s good to talk

The first, and easiest thing to do is communicate to members about high inflation and what it means for their pensions. This could be as simple as a letter and factsheet to help them consider and understand the inflation protection they have. If schemes want to take a further step, online content like animated videos is a very effective way of getting across complicated topics. Ultimately, making it ‘real’ for members with examples, like our earlier cup of tea scenario, makes it easier to understand and the more we can visualise this, the better.

Many members over age 55 aren’t aware of the existing support and retirement options available to them. For example, do your members know they can retire early and start to receive their retirement income (and tax-free lump sum)? Would late retirement, to benefit from longer employment, or taking phased retirement better suit some of your members’ needs and circumstances? Issuing targeted, personalised pre-retirement “warm up” communications is a great way to provide timely and relevant information to better support your members.

Increasing member choice

Members may want to retire but simply can’t afford to do so. However, there are benefit options that can be introduced to allow members to reshape their income without needing to transfer their benefits away from a DB scheme, allowing them to consider retiring as planned.

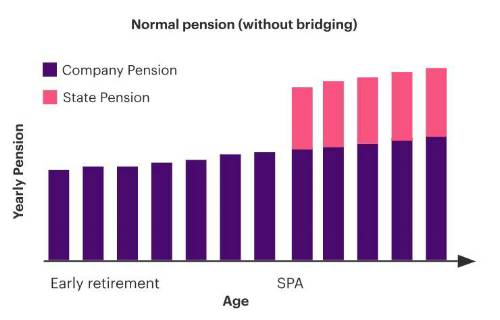

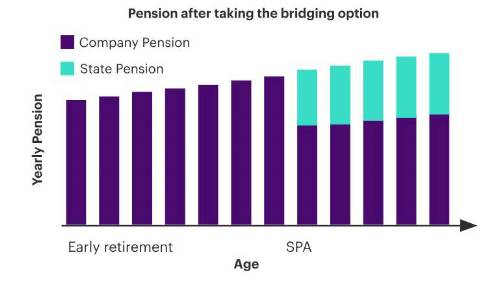

For example, those wanting to retire before State Pension age (66, rising to 67 between 2026-2028), a Bridging Pension Option allows members to have more income upfront until their State Pension kicks in, maintaining some of that ‘purchasing power’ they need.

Graphs showing that the Bridging Pension Option re-shapes the scheme pension

Retiring at age 60, for example, with a £14,000 a year income until State Pension Age might seem tough to live on, whereas £21,500 a year over that same period, in exchange for less thereafter might be enough to allow members to still fulfil their desire to retire when they want to.

As shown in DB member choice survey 2023, member options such as a Bridging Pension Option or Pension Increase Exchange are popular with members, but less than a third of DB schemes currently provide them. This gap provides pension schemes with an opportunity to do more to support their members. As well as providing members with greater flexibility, introducing these options can also lead to liability savings and journey plan acceleration on key measures, particularly buyout.

An uplifting response

DB scheme funding levels are generally much healthier today; analysis published by the Pensions Regulator suggests that the aggregate funding level of UK DB schemes had increased by around 20% over the past three years, with around three-quarters of schemes now estimated to have a funding surplus.

With the majority of DB schemes having had a funding deficit over recent years the possibility of granting discretionary increases was actively considered by many trustees, but with the recent improvements in funding levels and high levels of inflation this is becoming an increasingly common topic for discussion. This may require trustees to consider a different approach to this conversation with the sponsoring employer and to potentially take a different approach to the scheme’s journey plan. Many schemes have been targeting buyout, but for some an alternative route may now be more appropriate where the scheme’s capital is first pushed a bit harder, in a risk-managed way, to generate further surplus that could be used for the benefit of members, for example to provide discretionary increases, sponsors and the wider economy.

In conclusion

Times are tough for many, there is no doubt, but as you can hopefully see, there is still a fair bit that can be done to support members. Now, I think it’s time for that cup of tea.

|