“Based on today’s inflation figures, and following the government’s one-year suspension of the earnings element of the state pension triple lock, state pensioners will, subject to any late adjustments, receive an increase of 3.1% from April 2022. While significantly short of the 8.3% increase the earnings component would have delivered, this is still the third highest increase since the triple lock was introduced in its current form over a decade ago*.

“While some pensioners will be disappointed that the Government broke its Manifesto commitment to keep the triple lock, others will acknowledge the intergenerational challenges of granting an artificially high increase based on a statistical anomaly in the earnings figure due to the pandemic. An 8.3% earnings based increase would have represented a windfall bonus for state pensioners, but would have created a £7.5bn annual bill paid for from the National Insurance of today’s workers.

“However, if inflation continues to surge in the coming months, there’s a concern the 3.1% increase may fall short of cost of living increases come April 2022. With many pensioners heavily reliant on their state pension, and disproportionately affected by increased heating costs from the global energy squeeze, many could feel ‘left out in the cold’.”

What will a 3.1% increase in state pension mean for weekly payments in April 2022?

“Today’s inflation figure means those who reached state pension age after 6 April 2016 and who are receiving the full new state pension will see payments increase from £179.60 to £185.15 per week in April 2022**. Those who reached state pension age before 6 April 2016 and are receiving the full basic state pension will see payments increase from £137.60 to £141.85 per week, with many also having an entitlement to a state second pension.”

Reference:

*The triple lock was introduced by the collation government and first used to uprate the state pension in April 2011. However, the April 2011 increase used RPI as the measure for inflation, to ensure the basic state pension was in line with the previous uprating rules.

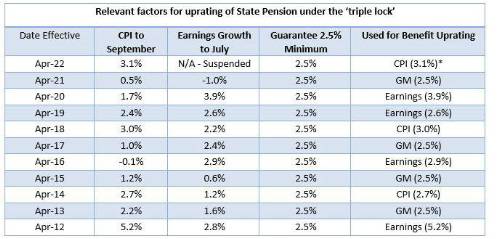

In its current form, since April 2012/13 the triple lock has ensured that the State Pension increases by the highest of the increase in earnings, price inflation (as measured by the CPI) or 2.5%.

**Numbers rounded to the nearest 5p

Relevant factors for uprating of State Pension under the ‘triple lock’

Aegon analysis of House of Commons library State Pension Uprating. Source: 2021 Benefits Uprating, p.8

*subject to final confirmation from DWP

|