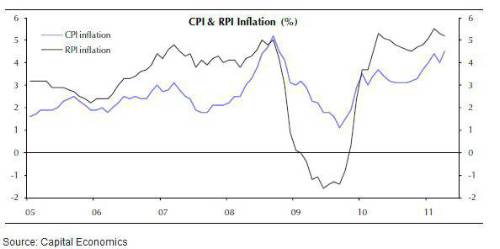

There was further bad news for the UK economy today with the publication of the consumer prices for April. CPI rose from 4% to 4.5% compared to expectations of about 4.1%.

This comes after a rare month when inflation was lower than expected in March as it fell by 0.3% to 4% (see chart below). The overshoot is mainly due to a big rise in transport costs in April that should largely reverse in May. For instance, the cost of air travel rose by 29% and sea fares by 22.3% during the month that can be mostly explained by the timing of Easter. The rises in duty on tobacco and alcohol also contributed to the increase as well as the continuing strength of energy prices.

Despite the convincing explanations for the rise in inflation, it will put further pressure on the MPC to increase interest rates. Last week, in the May inflation report, the Governor of the Bank of England, Mervyn King, warned that inflation would rise to 5% this year compared to the MPC's target on just 2%. By refusing to increase rates in the face of such a big discrepancy the committee has attracted much criticism for ignoring its mandate and accused of lacking credibility. The committee has been split with 3 members voting for a rise in rates, but the most hawkish member, Andrew Sentence, will leave the MPC at the end of this month.

Despite the short term outlook being for higher inflation, I believe that the Bank is correct to hang fire on rates for the time being. As Mr King has pointed out in his regular letter of explanation to the Chancellor, the reasons for the rise in inflation are largely outside the

Bank's control and raising rates would have little effect in bringing inflation down in the short term. The recent increase in indirect taxes, the rise in energy prices and other commodities and the weakness of sterling resulting in higher import costs have all contributed to inflation being much higher than the MPC's target of 2%. The effect of these should start to recede in towards the end of this year and continue into 2012.

The MPC is also very cognisant of the weakness of the UK economy that recorded zero growth in the 6 months to March 2012. The UK has recovered more slowly than most other developed markets with GDP in the first quarter of this year still 4% below the pre-recession peak whereas, by comparison, US and German GDP passed their previous peaks in the 4th quarter of 2010 and the first quarter of this year respectively. With such a fragile recovery evident in the UK at a time of severe fiscal consolidation, the MPC will not want to jeopardise the recovery even more by raising the cost of money.

Perhaps by early next year the success or otherwise of the government's austerity programme will be evident and the committee will be able to conduct monetary policy with a more independent mind, even if the economy is still weak. For now, however, the fragility of the UK's economic recovery combined with the largely transitory nature of the rise in inflation means the MPC is correct to hold rates at 0.5%.

Ted Scott, Director, Global Strategy

|