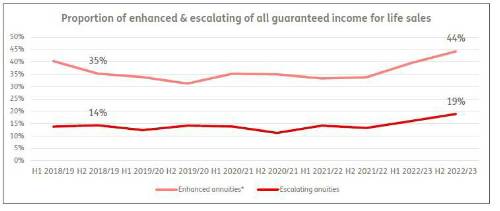

In the four years leading up to 2022/23, escalating GIfL products accounted for 13% of total sales. However, following the spike in inflation which saw the purchasing power of pensioners on fixed incomes drop markedly, sales of escalating GIfL rose to 16% in H1 2022/23 and then even further to around a fifth (19%) of all purchases in H2.

Opting for escalating guaranteed income for life solutions protects pensioners against inflation increases as rather than providing a fixed income, it will start at a lower level but rise over time either through a link to inflation or at a pre-agreed level.

The proportion of enhanced guaranteed income for life solutions has also risen markedly over the past four years from 35% of all sales to 44% between H2 2018/19 and H2 2022/23.

The FCA data on enhanced products accounts for those underwritten on impaired life or lifestyle factors (e.g. smoking) which provide an uplift in the rate available to offer a higher level of income.

Customers are also able to access enhanced rates underwritten on other factors such as their occupation or postcode details, but these are not included in this dataset..

Stephen Lowe, group communications director at retirement specialist Just Group, said the figures were evidence of better informed decisionmaking in the GIFL market: “It is positive that we are seeing customers opting for more complex products that may be more appropriate for their circumstances or offer a higher level of income.

“Our own analysis suggests around two-thirds of pension savers could be eligible for enhanced rates so we are creeping towards a more positive level of take-up. The increase in rates over the past year has brought guaranteed income back into the spotlight and it is pleasing to see people not rushing into decisions that may not deliver the best outcomes.

“The inflation shock over the past couple of years is also clearly influencing behaviours in the GIFL market with a notable uptick in escalating plans purchased over the 2022/23 year. However, customers should be careful that this is the right decision for them as the starting income will be lower so will need to pay out over several years to be likely to be worth inflation protection.”

|