Inheritance tax receipts for December 2022 totalled £545 million, up from £474 million in the same month a year ago. For the final quarter of the calendar year, the tax take hit £1.8 billion – the highest total on record and up from £1.4 billion last year.

Receipts for the current tax year to-date (April 2022-December 2022) reached £5.3 billion, which is £0.7 billion higher than through the same period a year earlier.

With three months of this year’s inheritance tax still to be collected and reported, the 2022/23 haul looks comfortably on course to beat last year’s total of £6.1 billion – and set yet another record for receipts.

Commenting on today’s data, Stephen Lowe, group communications director at retirement specialist Just Group, said: “The Treasury looks set to collect a record amount of cash from inheritance tax this financial year and forecasts predict nearly £8 billion a year will be raised from the levy by 2027/28.

“The combination of the freeze on the nil-rate band and rising property prices continues to funnel more inheritance tax into government coffers, especially in regions where house prices are far higher than the rest of the country.

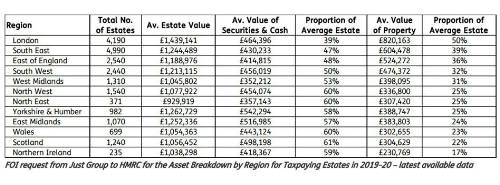

“Substantially more estates pay inheritance tax in London and the South East and a recent Just Group FOI found that the property accounted for 50% of the wealth in London estates paying IHT compared to 32% for the rest of the UK.

“Further significant house price rises through the pandemic are likely to have tipped many more estates over the inheritance tax threshold, perhaps without the homeowners even realising.

“It is yet another reminder for people of the importance of regularly assessing the value of their estate which includes getting an up-to-date valuation of any owned property.

“Professional, regulated advice can also help people work out the total value of their estate, calculate how much tax they may be likely to owe and understand what options they have to manage that tax bill.”

Andrew Tully, technical director at Canada Life commented: “The latest IHT receipts suggest we are on a trajectory for a record-breaking year, with the frozen thresholds catching more estates in a wider tax take. Inheritance tax is no longer an issue for the wealthy only, but with effective financial planning much can be done to minimise the impact of IHT on estates, including the use of trusts and gifting.

“Financial advisers will be helping clients navigate the complexities of IHT by discussing estate planning solutions with clients and their wider families. By engaging early, good planning can help to reduce or mitigate IHT so it’s essential anyone who thinks IHT may be an issue should seek expert advice.”

|