|

|

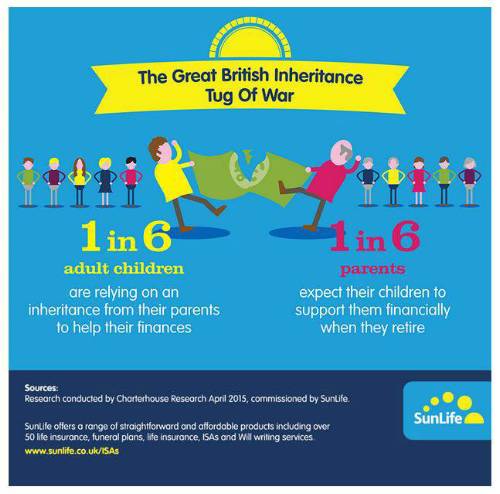

New research reveals that while one in six of us are relying on inheritance from our parents, equally, one in six retirees are looking to their grown up children to support them financially in their old age causing a generational financial tug of war. Parrents and children are banking on financial support from each other, according to the latest research from SunLife. |

The study reveals that while one in six (16%) of parents are expecting to be supported financially by their grown up kids when they retire, one in six (17 %) of adult children are relying on inheritance from their parents, causing an inheritance tug of war!

Furthermore, one in ten grown up children are relying on this inheritance so much that they think their parents are blowing too much of it!

SunLife’s research also reveals that as a percentage of income, older people are better off than younger generations; those age 55-70 have less than half (46%) their income allocated to fixed costs, compared to 57% for 18-24 year olds, 53% for 25-44 year olds and 51% for 45-54 year olds.

Ian Atkinson, head of brand at SunLife comments:

“Long gone are the days when pensioners spent their retirement doing crosswords and gardening, nowadays, the over 60s are just as likely to be skiing as sewing.

“In fact, independent research by Saga* found that among those aged between 65 and 74, spending on travel increased by 93 per cent between 2002 and 2012 and this is clearly bothering some people, with one in ten complaining that their parents are having too much fun with their ‘inheritance’!

“Furthermore, recent research has warned that middle-aged people can no longer rely on an inheritance as they will be almost retired before they receive any money – according to analysis by The Telegraph earlier this year, in 1999, the average Briton who inherited money was aged just under 53, now it is rapidly approaching 60**

“By assuming we will get financial support from our families rather than making financial plans of our own, many of us are leaving our financial futures uncertain.

“Our research shows that on average, UK households have £381 spare cash a month – which is the equivalent of £38 a week per person. Putting just some of this aside each month could make a big difference.”

1 in 6 adult children are RELYING on INHERITANCE from their parents

1 in 6 parents EXPECT THEIR CHILDREN TO SUPPORT THEM when they retire

1 in 10 adult children say their PARENTS ARE ‘BLOWING’ THEIR INHERITANCE

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.