With roughly one third of drawdown sales in the wider market on an unadvised basis, there is concern that those who do not take advice may be running down their pension pots too quickly and may exhaust their savings. Royal London has therefore analysed data from a sample of over 17,000 of its customers who are supported by financial advice to see how they are handling their fund in retirement to see what ‘best practice’ looks like. These are all customers whose adviser is using the firm’s ‘Drawdown Governance Service’ which provides advisers with quarterly red/amber/green assessments as to how sustainably individuals are using their pension pots.

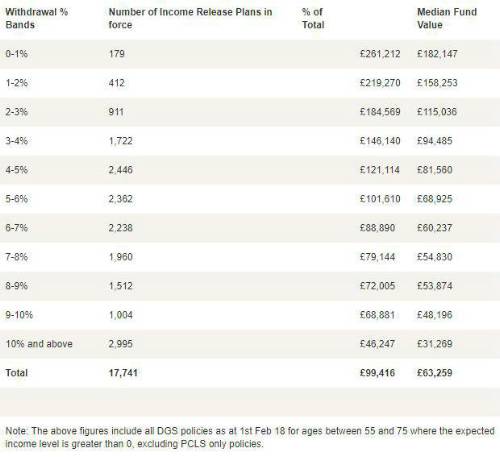

The following table show how many retirees are drawing 0-1% per year, 1-2% per year and so forth, and also provides the mean and median fund value for those in each band:

Table: Data from advised Royal London customers on typical withdrawal rates from drawdown products, together with average pot size

Table 1 shows that there is a diversity of ways in which people are approaching handling their retirement savings, depending in particular on the size of the drawdown account. Key findings are:

The most common rate of withdrawal is in the 4-5% band, which is broadly in line with traditional notions of a ‘sustainable’ rate of withdrawal; over a third of the sample are withdrawing between 3% and 6% per year;

Around 1 in 6 of the sample is withdrawing over 10% per year, but these are on average those with the smallest pots – the median pot size for this group is just over £30,000; this strongly suggests that these pots are not being used to support people throughout retirement and that there are other (larger) sources of income on which the client is relying; for example, some savers may be rapidly running down one pot earlier in retirement before state pension and occupational pensions come into payment;

There is a very clear correlation between size of pot and rate of withdrawal; those with the largest pots are taking the smallest percentage withdrawals;

Commenting on the figures, Steve Webb, Director of Policy at Royal London said: ‘When managing a significant pension pot in retirement, taking financial advice helps individuals to make sure that their money lasts through their retirement. Our data shows that for those with larger pots, which are likely to form a major part of their retirement income, current withdrawal rates for those taking advice are typically in low single figures – there is no sign of ‘Lamborghinis’ in our data.

‘Faster withdrawal rates tend to be associated with much smaller pots and this is likely to be for individuals who have other sources of income in retirement. This data suggests that for advised customers there is little reason for concern that pension freedoms are being used irresponsibly, but does show the potential advantages in getting more people take advice and guidance at retirement’.

|