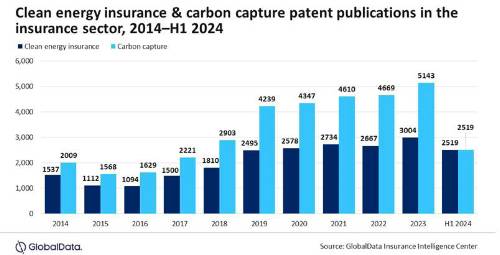

An analysis of GlobalData's Patent Analytics database reveals a notable uptick in patents related to clean energy insurance and carbon capture in recent years. The number of patents for clean energy insurance skyrocketed substantially from 1,537 in 2014 to 3,004 in 2023. Similarly, the patents for carbon capture within the insurance sector increased from 2,009 in 2014 to 5,143 in 2023.

This trend underscores a strategic shift towards developing and targeting these specialized products. Furthermore, the H1 2024 patents data suggest ongoing innovation within these segments.

Guillaume Anns, Insurance Analyst at GlobalData, comments: "The surge in patents for clean energy insurance and carbon capture within the insurance industry reflects a strategic focus on supporting sustainable energy initiatives. As countries aim to achieve their net-zero commitments, insurers are developing new products and services to cater to this evolving landscape."

An exemplary instance of this industry shift is the collaboration between Zurich Insurance Group and Aon to establish a clean energy insurance facility for hydrogen projects. This collaboration marks a significant advancement in supporting the transition towards sustainable energy sources. The oversubscription of the facility underscores the high demand for insurance solutions in the clean energy sector, highlighting the growing interest in this area.

Anns continues: "The involvement of key players like Zurich and Aon emphasizes the critical role of risk management and financial protection in advancing clean energy projects. By offering comprehensive coverage for blue and green hydrogen projects, as well as carbon capture utilization and storage (CCUS) technologies, the facility addresses the complex risks associated with these initiatives, providing developers and investors with the confidence needed to pursue such ventures."

The insurance industry's dedication to embracing cleaner technologies is becoming increasingly apparent, with insurers implementing measures to limit coverage for carbon-intensive sectors like coal mining. Companies like Munich Re are setting ambitious targets to reduce emissions linked to underwriting activities, demonstrating a commitment to a sustainable operational framework.

Anns concludes: “The initiatives undertaken by industry leaders like Zurich, Aon and Munich Re mark a significant step forward in supporting clean energy investments. By providing comprehensive insurance solutions for hydrogen projects and addressing the risks associated with clean energy infrastructure, these collaborations play a crucial role in accelerating the energy transition and meeting net-zero targets.”

|