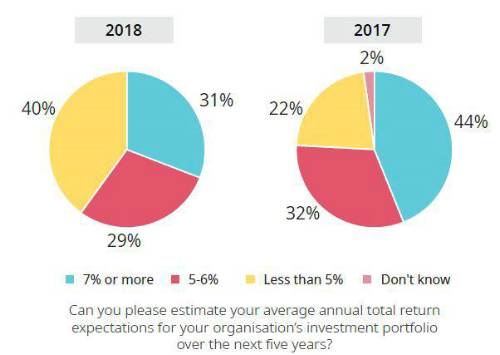

The study – which surveyed 157 insurance investors representing a total of $10 trillion in assets – found that two-fifths (40%) of investors expect their average annual returns to be less than 5% over the next five years, a stark increase on 22% of insurance investors a year ago.

Insurers’ confidence levels in achieving their desired returns have also slipped from 61% to just over half at 54%. At the same time, insurers’ average portfolio holding periods have also fallen, with those remaining invested for a full market cycle slipping from 14% to 10%.

In turn, their portfolio turnover has also increased, with insurers selling on average 19% of their portfolios each year, up on 13% a year ago.

Paul Forshaw, Global Head of Insurance Asset Management, Schroders, said: “Global markets have enjoyed a great run in recent years, our survey shows that insurers are now growing wary which could indicate that this may be coming to an end.

“The insurers we have surveyed are increasingly looking at bespoke risk-managed solutions and diversifying private assets in order to generate the returns they require with acceptable risk. Sustainability is also coming sharply into focus as a feature of our insurance clients’ investment requirements.

“The survey confirms the importance of asset managers having insurance-specific investment expertise to deliver the actively managed tailored solutions required to meet insurers increasingly sophisticated objectives.”

Politics and world events were cited by 26% of insurers as the most pressing factor that could affect the performance of their portfolios, with 25% flagging higher interest rates and 23% a global economic slowdown.

In terms of specific investment issues, equity market volatility, interest rate risk and credit defaults were the three main market risks highlighted by insurers. Better risk-managed investment solutions were the innovation the majority of insurers (62%) would like to see more of over the next 12 months.

Insurers are expecting to increase their private asset allocations from 9% to 11% over the next 12 months with the aim of higher returns, diversification and better risk-management the key motivations.

Almost three-quarters of insurers’ assets (73%) are currently actively-managed, the study found.

Furthermore, 73% of insurers expect the role of sustainable investing to become more important, echoing a wider shift in the investment space, with insurers now placing a greater emphasis on the sustainability focus of their investments compared with a year ago.

Please find attached the full report

The first part of the Schroders Institutional Investor Study 2018 was released in September. Focused on sustainability, it found that this remained a non-core investment consideration for institutional investors.

*This global study was commissioned for a second year by Schroders and undertaken by independent research agency, CoreData Research, studying institutional investors representing a variety of institutions, including pension funds, foundations, endowments and sovereign wealth funds. The research was carried out via an extensive global survey during June 2018. The 650 institutional respondents were split as follows: 175 in North America, 250 in Europe, 175 in Asia and 50 in Latin America. Respondents were sourced from 15 different countries. Specifically, for this survey, the responses of 157 insurance investors were analysed.

|