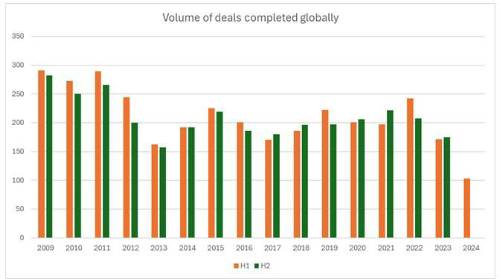

The insurance carrier M&A landscape saw the lowest number of deals (103) completed in 15 years in the first half of 2024, according to Clyde & Co’s mid-year Growth report update.

The findings follow a notable decline in deal volumes throughout 2023 in response to a surge in inflation and interest rate cuts. Since then, a combination of factors has further reduced deal activity globally to a crawl. In the first half of this year, cash-rich carriers, which would traditionally have been active in the market, have been retaining capital while interest rates are high.

The slow pace has been exacerbated by sellers’ high pricing expectations and an increasing premium required for the integration of tech systems, as innovation widens the gap with outdated platforms. Deal dynamics are also changing with a greater emphasis placed on securing talent.

However, insight from Clyde & Co’s report suggests that after the slowest half year since this report began in 2021, the pieces of the puzzle needed to bring the market back to life may be falling into place.

Eva-Maria Barbosa, Partner, Clyde & Co said “Insurance M&A, for the remainder of 2024 and into 2025, will likely be driven by larger scale transactions. While the total number may not increase dramatically, we are increasingly likely to see deals that span a number of jurisdictions with some of the major carriers now looking to take on books or businesses which span 8-10 countries in one swoop.”

Peter Hodgins, Partner, Clyde & Co added: “The US election will bring us near the end of a period of exceptional political change. Interest rates are broadly tracking downwards. While acquirers are likely to become more bullish, sellers may be running out of road. Businesses that have relied on financing will look to divest non-core businesses or underperforming operations.”

Regional analyses

UK

M&A activity in the UK market remained low during the first half of the year. However speculation is increasing on an uptick in M&A activity at the larger end of the capitalisation spectrum. This is particularly notable amongst UK-listed carriers, several of which have been touted as would-be takeover targets for foreign suitors, attracted by the combination of strong fundamental performance and low valuations. Activity for the remainder of the year is likely to focus on bolt-ons and niche acquisitions.

Europe

The factors that have dampened carrier acquisitions globally have also been felt across Europe. However, the impact of lower interest rates and greater political clarity, combined with the implementation of the EU mobility directive, may serve as catalysts for an increase in multi-market deals.

US

The US and Canada saw the highest number of insurance underwriting deals of any region in the first half of 2024. 40 transactions closed, with Brookfield Reinsurance’s acquisition of American Equity Investment Life (AEL) for $3,587bn representing the largest deal completed globally. The US was also the only region to witness multiple billion-dollar sales. However, by its own high standards, M&A activity in North America remains muted. The election in November will be a watershed moment. A more settled economic picture, with interest rate and inflation pressures abating, could provide the necessary deal stimulus.

Middle East

The five deals completed in the first half of the year continued a trend which has been visible in the Middle East for the last five years: consolidation. Local carriers are strengthening their regional footprints to capitalise on the growth opportunities across the region. While some global insurers have been reducing their presence, international specialty carriers have been increasingly focused on lines such as reinsurance and trade credit, establishing smaller-scale, targeted operations in the DIFC or ADGM to gain access to the region’s burgeoning markets.

APAC

The M&A market has been comparatively resilient in 2024. While deal activity is down year-on-year, this decline has been less pronounced than in the US or Europe. There have also been several large-scale, cross-border transactions, bucking the trend seen in other regions. The major Japanese carriers continue to expand their regional footprints

South Africa

The global slowdown in M&A activity has also been felt in South Africa. With the macroeconomic factors of high inflation, high interest rates, and lower economic growth being the key factors. The muted M&A market has been further exacerbated by energy-generating issues and political uncertainty before May’s elections.

South America

Global players have continued to consolidate their positions across multiple geographies. HDI’s acquisition of Liberty Seguros in Chile, Colombia, and Ecuador this year, follows their takeover of Liberty’s Brazilian operations at the end of 2023. Combined, these acquisitions have significantly strengthened HDI’s presence across the continent.

In the P&C space, market dynamics are also driving increased interest in specialty carriers. Data and technological integration have become key considerations for any insurance deal. Current conditions have largely not been conducive for significant deal activity, but they have enabled high performing businesses to plan growth strategies carefully. As we seemingly turn a corner, the path ahead may become clearer. Any revival is unlikely to be uniform globally, or move at the same pace, but conditions are improving.

|