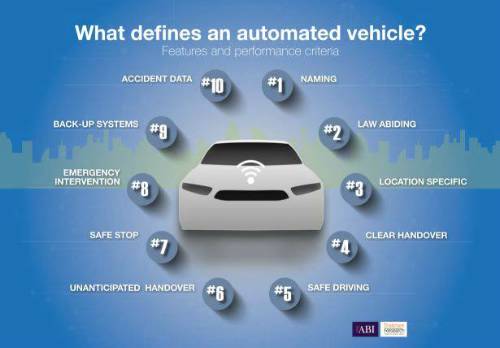

The 10 key features and performance criteria required of a truly automated vehicle:

Naming: clearly describes automated capability

Law abiding: complies with UK traffic laws and the Highway Code

Location specific: functionality is limited to specific types of roads or areas via geo-fencing

Clear handover: transfer of driving control follows a clear ‘offer and confirm’ process

Safe driving: vehicle can manage all reasonably expected situations by itself

Unanticipated handover: adequate and appropriate notice must be given if the vehicle needs to unexpectedly hand back driving control

Safe stop: vehicle executes an appropriate ‘safe stop’ if unable to continue or the driver does not take back control

Emergency intervention: vehicles can avoid or prevent an accident by responding to an emergency

Back-up systems: safeguards step in if any systems fail

Accident data: record and report what systems were in use at the time of an accident

Ben Howarth, Senior Policy Adviser for Motor and Liability at the Association of British Insurers, said: “Truly automated vehicles have the potential to drastically reduce road accidents, cut delays and make it easier for people who cannot drive to get around. However, there will inevitably be a transition period from today’s cars to the vehicles of the future, via vehicles which offer gradually increasing levels of autonomy. There is the potential for confusion during this interim stage when people could wrongly think their vehicles can be left alone to manage a journey independently. Insurers want to see manufacturers being absolutely clear about how they describe what their vehicles can do – and we think this checklist of ten things which define a truly automated vehicle should be adopted across the industry to help give clarity to consumers.”

Matthew Avery, director of research at Thatcham Research comments: “The insurance industry welcomes the UK Government's commitment in the Automated and Electric Vehicles Bill to create a list of automated vehicles. It is crucial, therefore, that that there is a clear definition of what constitutes an automated vehicle. Regulators and insurers require this to classify and insure vehicles appropriately, while consumers need to understand the functionality and capability of the vehicle and their own responsibilities. Consequently, a system that needs the driver to control or monitor the vehicle in any way cannot be classified as automated.”

|