More ransomware attacks an insurer opportunity

KP Snacks’ February cyberattack again demonstrates the threat to which companies are exposed. About $6 trillion was lost globally to cybercrime in 2021, a significant increase vs the $600 billion McAfee estimated in 2018. While data for 2022 is sparse, there seems to be a consensus that attack numbers and costs are escalating. Data sharing and interconnectivity rank high as attractive targets for criminals. Widespread adoption of the cloud to store and process data heightens the operational challenges, with supply-chain vulnerabilities exploited for the first time in 2020.

Ransomware attacks advance strongly and insurers may benefit

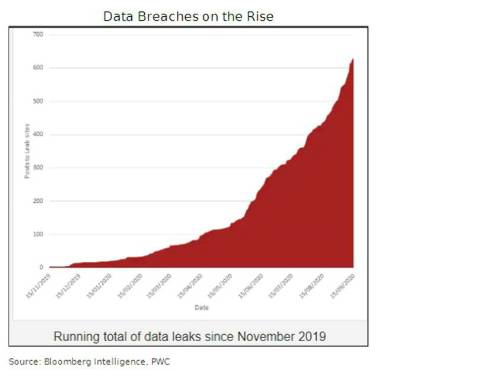

There were 623 million ransomware attacks globally in 2021 according to Sonic wall, representing a 105% year on year increase. The UK saw a 228% surge and a 65% increase in never-seen-before malware. The good news for insurers is that there’s been a strong rise in cyber insurance premium rates in 2022, with, for example, Beazley’s 1H cyber premiums up 77%. As companies become more aware of the debilitating effects of cyberattacks, it’s logical this will lead to more purchases of cyber cover and a large source of new business for insurers.

Cyber risk becoming a headache for many

Insurers have the infrastructure to work collaboratively with clients and provide services before and after malware incidents, this minimising potentially negative outcomes. Cyber threats and infiltration techniques are moving to more sustained levels, known as advanced persistent threats, away from quick, one-off acts. In these case, criminals gain unauthorised access to computer networks and remain undetected. Mandiant reports that 25% of breaches clients had more than one threat group, which sometimes worked in concert.

Kevin Ryan, BI Senior Industry Analyst (Insurance), added: “The cyber attack on the Royal Mail could represent the latest very public manifestation of what we believe to be a sharp rise in ransomware attacks. Though it’s unclear whether this is the issue at the post office, there’s been a dramatic rise in ransomware incidents since the Ukraine war began and a corresponding decline in data breaches. Bad actors seem increasingly likely to use ransomware as a weapon. The rise in ransomware attacks may be unrelated to the Russian invasion of Ukraine but the rise in number of incidents is striking.

“The Royal Mail incident illustrates what we see as a burgeoning new business opportunity for insurers such as Axa, Axis and Beazley, which have focused on this niche market.”

|