A key trend discussed in GlobalData’s report, ‘Digital Challengers in Insurance – Thematic Research’, is the emergence of on-demand policies where customers can purchase insurance by the hour, day or week - normally using a provider’s app. Variations can be seen across a lot of personal lines, with flexibility becoming a key trend as start-ups offer home or gadget insurance, which can be adjusted at any time.

Ben Carey-Evans, Insurance Analyst at GlobalData, said: “The digital challenge in insurance continues to grow and the scale of funding in 2018 is proof of that. It has lagged behind other sectors, given what Uber and Netflix provide in transport and entertainment, respectively. However, this type of flexible and instant service is more commonplace with a range of start-ups thriving in both personal and commercial lines. This has even prompted traditional insurers such as Aviva to respond with the release of its Aviva Plus, which allowed customers to pay monthly subscriptions and tweak cover levels during the contract.”

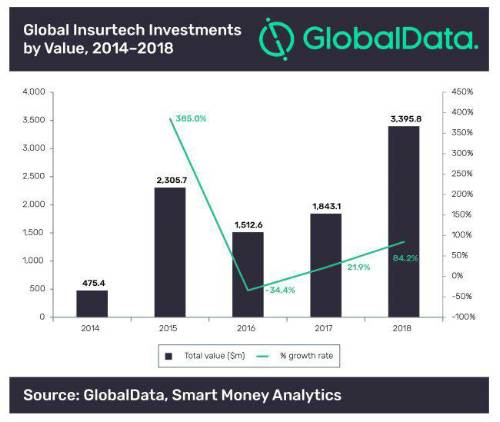

The UK has been at the forefront of insurance industry modernization, with start-ups such as Brolly, Zego, Homelyfe, ByMiles and DeadHappy all offering flexible and digital policies across a range of different insurance lines. GlobalData’s Smart Money analytics show that UK insurtechs received the second highest level of investment globally in 2018, with $9.8bn coming from 101 completed deals.

Carey-Evans concludes: “Established UK players have to adapt to progress made by start-ups or consumers will begin to go elsewhere. They can no longer rely on their trusted brand names, as they are not just competing against start-ups but can be left behind by their competitors partnering or investing in them.”

|