The report highlights the dramatic way in which work is changing and with it the way we thinking about the risk to health and wellbeing at work.

Commenting on the impact that wellbeing in the workplace should have for insurer, Richard Purcell, Insurance Innovation Lead, Life and Financial Services, Hymans Robertson, says: “It is clear that new technology and changing attitudes are transforming the way we work and this is impacting on our health in new and different ways. Traditional means used by insurers to measure the impact of work are becoming redundant while the risks faced by insurers are changing. They will need to find new techniques to assess risk, perhaps looking more at how, when and where we work to form a better picture, as well as starting to design products that recognise these different risks to protect employees.”

“The emphasis now being placed on wellbeing shows it can also be a way in which insurers can engage with customers more effectively and if they can do that then perhaps it can help to manage risk proactively. Some may want to go further and think about how they can use wellbeing as a way to support individuals and employers in proactively managing risks to lower claims costs that can be passed back to customers Innovative insurers could use wellbeing itself to act as a proxy for health when assessing risk in the future. ”

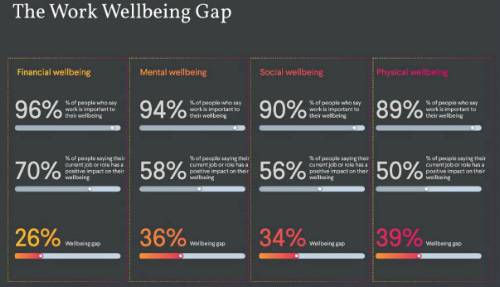

The work-wellbeing gap was defined as the difference between how important work in general is to people’s wellbeing in different categories and the extent to which their current role is actually having a positive impact on their wellbeing in these areas. The research looked at four areas – financial, mental, social and physical wellbeing - and identified that workplaces were failing to meet expectations in all areas (see below). The greatest of these gaps was in physical wellbeing at 39%, recognising that many of us are not sufficiently active at work.

Commenting on the findings, Richard Purcell, continues: “Clearly a lot more can be done by insurers and employers to encourage a more positive and healthy workforce. It isn’t surprising that work is most important to people’s financial wellbeing given its role in earning money, however mental, social and physical wellbeing were not far behind. While the financial wellbeing gap was the smallest, it was still a sizeable quarter of people (26%) who said work didn’t fulfil that. Employers should recognise that the needs of the workforce are changing and look at ways they can create a working environment that contributes more positively to people’s wellbeing.”

One key finding from the survey was that well over a third of people (39%) said that satisfaction with the job itself had a positive impact on feeling of wellbeing at work. This was followed closely by friendships with colleagues, identified by a third (32%) of respondents, and the ability to work flexible hours (29%). The majority of people questioned are now enjoying the flexibility of being able to work from home at least occasionally. Good holiday allowance, which is often the focus for benefits packages at work was lower down in the list but a quarter (23%) said this had an impact on their wellbeing.

In the research 53% of those questioned said they would always choose an employer that positively contributed to their wellbeing, even if it meant earning less money. For many people the lack of wellbeing at work has an impact on whether they want to go work at all. A fifth (21%) of people said that going to work is something they dread. As many as a third (32%) of millennials and 38% of gig workers claim that they feel like this, perhaps reflecting that many of the jobs held both by younger people and those who move from job to job as gig workers do, provide fewer of the factors that contribute to the feeling of wellbeing.

Commenting further on how insurers can adapt to the rise in the importance of work-wellbeing, Richard Purcell adds: “Taking these findings on board insurers may wish to consider both changes to underwriting and changes to the products they offer. The use of occupation as a rating factor may become less useful occupations evolve over time. Other metrics such as salary or those that rate the use of screens, travel time and physical activity levels could be used instead. Dynamic underwriting would allow for their retraining of employees over their career as they seek greater wellbeing in their work. The rise of the gig worker also poses a question for insurance underwriters. They are an important and growing section of the economy that is currently underserved by the insurance markets. How much appetite do insurers have to address this risk?”

“Insurers can also consider changes to the products they offer to meet the increasing emphasis on work-wellbeing. They could develop products that support people’s desire for wellbeing improvement, with wellbeing programmes that lead to lower claims. These types of products are likely to have a strong appeal with customers. Insurers will also need to develop products that embrace the increasingly flexible nature of work and the phasing of retirement with premiums or cover levels that can be adjusted.”

Closing the Well Being Gap

|