Insurers and insurance asset managers are set to continue to increase their allocation to alternative asset classes over the next three years. According to a new survey* among investment management professionals in Life Insurance companies, London Markets (re)insurers and at insurance investment managers, 89% of those surveyed believe this, with 13% expecting a dramatic increase.

Some 73% of those surveyed said this is because there is now greater transparency and reporting around investing in alternatives, and this is followed by 62% who believe it is due to there being more investment choice in the sector.

The study, from Ortec Finance, the leading global provider of risk and return management solutions for insurers and other financial services companies, found that 59% said insurers and insurance asset managers will increase their allocation to alternatives because they offer a good way to diversify portfolios, and 20% said it was primarily because they offer good yields.

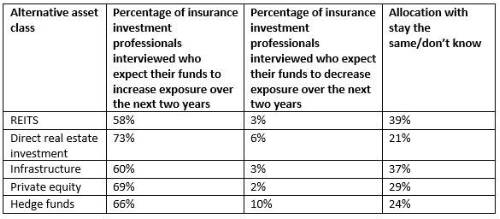

In terms of which alternative asset classes insurance investment management professionals plan to increase allocations to over the next two years, 73% expect an increase to direct real estate investment, and 69% and 66% expect allocations to private equity and hedge funds respectively to rise.

One consequence of the increased focus on alternatives is that the level of direct investing from insurers and insurance asset managers rather than fund investing - is set to rise. Over the next five years, 16% of respondents to Ortec Finance’s survey expect a dramatic increase in this from insurers and insurance asset managers, and a further 79% anticipate a slight rise.

Hamish Bailey, Managing Director UK, and Head of Insurance & Investment said: “The benefits of investing in alternatives are many, from diversification of portfolios to returns linked to inflation. There is also greater transparency around reporting, and more investment opportunities in these sectors, so it is not surprising to see insurers continuing to increase their allocations to these markets, despite rising rates.

“However, as their investment portfolios change so too do the risks they face, and it is imperative that insurers have a good understanding of these and robust strategies for managing them.”

Some 97% of respondents to Ortec Finance’s research said they will need to invest more in scenario analysis and stress testing as a result of increasing their allocation to alternative asset classes.

|