The latest briefing, produced in collaboration with CB Insights focuses on InsurTech for the Life & Health insurance industry and how the complexity of change occurring within the value chain is much greater than in other insurance subsectors, and the potential positive impact on the quality of life for the customer is substantially more profound. The briefing focuses on three key areas of Life & Health value chain disruption: data, customer and product.

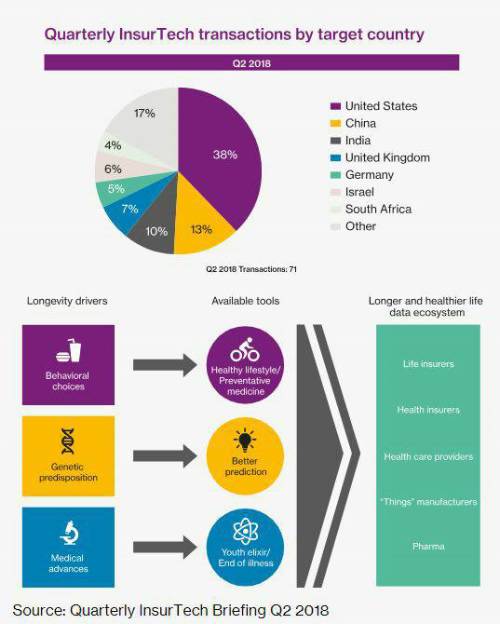

New forms of underwriting data are expanding exponentially as a result of advances in the understanding of the human body and the proliferation of wearable sensors that track activity and monitor behaviours. InsurTech companies are developing tools to harness this data in order to create insightful information that can be used to enhance Life & Health products. As the ecosystem for data and analytics continues to develop, one potential outcome may be greater convergence between Health insurers and Life insurers.

InsurTech firms are also creating more customer-centric life & health insurance products that alleviate the confusion and complexity of the purchasing process while also developing solutions that are tailored to an individual’s changing insurance needs.

Emerging technology enables the development of customized insurance offerings that better align sales incentives and help to resolve compliance issues. It also creates a more effective distribution channel and can better address the protection gap that results from one size fits all products and rising healthcare costs.

Finally, InsurTech companies are providing access to around-the-clock services using artificial intelligence, machine learning, and chat-bots, all in an effort to place greater emphasis on risk mitigation and prevention. For Life & Health underwriters, they provide increasingly better tools to predict life expectancy and the probability of illness while also providing insurers with an opportunity to develop real time dialogues with their customers to increase engagement and to deliver a value proposition designed to help customers live longer and healthier lives.

“While P&C insurers certainly have a chance to develop real time dialogues with their customers, the opportunity hardly compares with that for Life & Health insurers” says Rafal Walkiewicz, Chief Executive Officer of Willis Towers Watson Securities. “We believe that the eventual winners in the Life & Health industry will be the ones who shift their attention from primarily offering death benefits, investment support and coverage for protection gaps to offering customers a true partnership to live longer and healthier lives.”

Greg Solomon, Head of Life & Health Reinsurance at Willis Re International, says: “The application of InsurTech in the Life & Health sector ranges from the explicit use of new technologies to distribute and underwrite insurance policies, to more indirect usage such as wellness, where technology is deployed simply to make policyholders healthier and happier. But everything overlaps. Innovations are either driven by (re)insurers or used by them, or engaged by prospects and policyholders, which affects (re)insurers’ experiences. The change will be profound, but many incumbent carriers have some way to travel yet.

Download Quarterly InsurTech Briefing

|