-

Geopolitical and societal risks dominate the World Economic Forum Global Risks 2015 report

-

Interstate conflict with regional consequences is viewed as the number one global risk in terms of likelihood, with water crises ranking highest in terms of impact

-

Experts rate environmental risks more prominently than economic ones

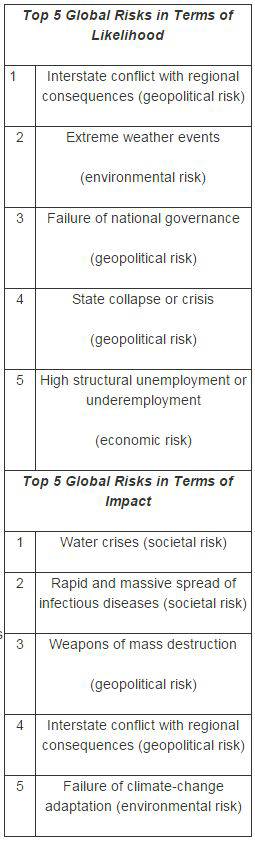

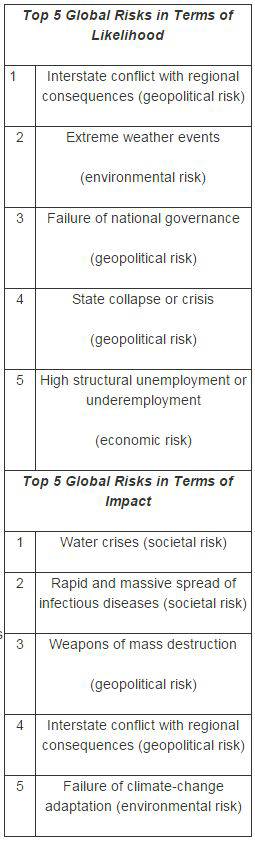

The report, which every year features an assessment by experts on the top global risks in terms of likelihood and potential impact over the coming 10 years, finds interstate conflict with regional consequences as the number one global risk in terms of likelihood, and the fourth most serious risk in terms of impact. In terms of likelihood, as a risk it exceeds extreme weather events (2), failure of national governance systems (3), state collapse or crisis (4) and high structural unemployment or underemployment (5).

In looking at global risks in terms of their potential impact, the nearly 900 experts that took part in the Global Risk Perception Survey rated water crises as the greatest risk facing the world. Other top risks alongside that and interstate conflict in terms of impact are: rapid and massive spread of infectious diseases (2), weapons of mass destruction (3) and failure of climate change  adaptation (5).

With the 28 global risks that were assessed in 2015 grouped into five categories – economic, environmental, geopolitical, societal and technological – 2015 stands out as a year when geopolitical risks, having been largely absent from the landscape of leading risks for the past half-decade, returns to the fore. With geopolitics increasingly influencing the global economy, these risks account for three of the five most likely, and two of the most potentially impactful, risks in 2015. Also in this category, three risks stand out as having intensified the most since 2014 in terms of likelihood and impact. These are interstate conflict with regional consequences, weapons of mass destruction and terrorist attacks.

The risk landscape in 2015 also shows that there remains concern over the world’s ability to solve its most pressing societal issues, as societies are under threat from economic, environmental and geopolitical risks. Indeed, the societal risk accounts for the top two potentially impactful risks.

Also noteworthy is the presence of more environmental risks among the top risks than economic ones. This comes as a result of a marked increase in experts’ negative assessment of existing preparations to cope with challenges such as extreme weather and climate change, rather than owing to a diminution of fears over chronic economic risks such as unemployment and underemployment or fiscal crises, which have remained relatively stable from 2014.

“Twenty-five years after the fall of the Berlin Wall, the world again faces the risk of major conflict between states,” said Margareta Drzeniek-Hanouz, Lead Economist, World Economic Forum. “However, today the means to wage such conflict, whether through cyberattack, competition for resources or sanctions and other economic tools, is broader than ever. Addressing all these possible triggers and seeking to return the world to a path of partnership, rather than competition, should be a priority for leaders as we enter 2015.”

In addition to assessing the likelihood and potential impact of these 28 global risks, Global Risks 2015 examines the interconnections between risks, as well as how they interplay with trends shaping the short- to medium-term risk landscape. It also offers analysis of three specific cases which emerge from the interconnections maps: the interplay between geopolitics and economics, the risks related to rapid and unplanned urbanization in developing countries and one on emerging technologies.

On urbanization, the report considers how best to build sufficient resilience to mitigate the challenges associated with managing the world’s rapid and historical transition from predominantly rural to urban living.

“Without doubt, urbanization has increased social well-being. But when cities develop too rapidly, their vulnerability increases: pandemics; breakdowns of or attacks on power, water or transport systems; and the effects of climate change are all major threats,” said Axel P. Lehmann, Chief Risk Officer at Zurich Insurance Group.

The rapid pace of innovation in emerging technologies, from synthetic biology to artificial intelligence, also has far-reaching societal, economic and ethical implications. Developing regulatory environments that are adaptive enough to safeguard their rapid development and allow their benefits to be reaped, while preventing their misuse and any unforeseen negative consequences is a critical challenge for leaders.

John Drzik, President of Global Risk and Specialties at Marsh, said:

“Innovation is critical to global prosperity, but also creates new risks. We must anticipate the issues that will arise from emerging technologies, and develop the safeguards and governance to prevent avoidable disasters.”

The report also provides analysis related to global risks for which respondents feel their own region is least prepared, as well as on the global risks on which they feel most progress has been made over the last 10 years. It also presents for the first time country-level data on how businesses perceive global risks in their countries, which can be accessed here. Moreover, the report features three examples of risk management and resilience practices related to extreme weather events.

The Global Risks 2015 report has been developed with the support of Strategic Partners Marsh & McLennan Companies and Zurich Insurance Group. The report also benefited from the collaboration of its academic advisers: the Oxford Martin School (University of Oxford), the National University of Singapore, the Wharton Risk Management and Decision Processes Center (University of Pennsylvania), and the Advisory Board of the Global Risks 2015 report.

The report can be read in full here |

adaptation (5).

adaptation (5).