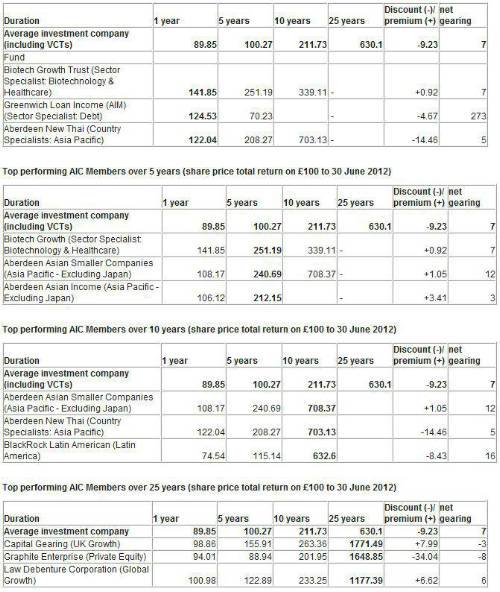

With the Olympic countdown well underway, the Association of Investment Companies (AIC) has published a list of the top performing member companies over both the short distance (1 year), middle distance (5 years), long distance (10 years) and marathon (25 years).

Several of the medal winners have been consistent strong performers, racking up multiple medals over different time frames.

Asia Pacific companies have dominated the performance tables over 1, 5 and 10 years, with some specialist companies also featuring. But over 25 years, it is the Global Growth, UK Growth, and Private Equity companies topping the performance tables. Interestingly, all but two of the award winners are currently standing on discounts below the overall industry average, with some on premiums.

Over the short distance, Biotech Growth Trust took a gold medal for 1 year performance, up 42% over the last year to 30 June 2012 in share price total return terms. But it also took a gold medal over the middle distance (5 years), up 151%, and has also considerably outperformed the industry average over long distance (10 years). Biotech Growth Trust was on a premium of 1% at 30 June 2012.

Other multiple award winners included Aberdeen New Thai, which despite racking up both a bronze medal over 1 year and a silver medal over 10 years, is on a discount of 14% compared to an overall industry average discount of 9% (although its discount is consistent with its sector average, the Country Specialists: Asia Pacific sector). Over the last year to 30 June 2012, Aberdeen New Thai is up 22% and over 10 years to 30 June 2012, the company is up 603%, with a £100 investment growing to £703, making it the second top performing AIC member over 10 years.

Aberdeen Asian Smaller Companies also took two medals, a silver medal over 5 years and a gold medal over 10 years. Over 5 years the company is up 141% in share price total return terms to 30 June 2012, and over 10 years it is up 608%. The company was on a premium of 1% at 30 June 2012 compared to its sector average discount in the Asia Pacific Excluding Japan sector of 6%. Also in the Aberdeen Asset Managers stable, Aberdeen Asian Income took a bronze medal over 5 years, up 112% over 5 years to 30 June 2012.

Other notable winners included Greenwich Loan Income (AIM), which won a silver medal over 1 year, up 25% over the year to 30 June 2012 in share price total return terms. This company has had a more volatile performance record over 5 years. BlackRock Latin American won a bronze medal over 10 years, up 533% to 30 June 2012 in share price total return terms. It has also outperformed the industry average over 5 years.

Marathon effort

Capital Gearing, a UK Growth investment company, is the top performing AIC Member over 25 years. A £100 investment in Capital Gearing over 25 years to 30 June 2012 would have grown to £1,771. Graphite Enterprise, a Private Equity investment company, was the silver medal winner with a £100 investment over 25 years to 30 June 2012 growing to £1,649. In third place was Law Debenture Corporation, a Global Growth investment company. A £100 investment into this trust 25 years ago would have grown to £1,177 in share price total return terms.

Ian Sayers, Director General, Association of Investment Companies (AIC) said: "It's interesting to see that many of the award winners over the shorter-term have also had a tendency to outperform the wider sector over other medium to longer-term time frames too. Clearly, there has been a tendency for Asia and specialist sectors to outperform, but over the very long-term, the Global Growth and UK Growth sectors are demonstrating why these core investment company sectors should never be overlooked. And with a private equity investment company featuring in the top three over 25 years, it is a good reminder of this sector's long-term growth potential.

"Whilst it's interesting to look at performance trends, these should never be looked at in isolation and are only part of the picture. Geographical weightings, portfolio holdings, gearing, valuations and charges should all be looked at and, if investors are in any doubt, it's worth seeking financial advice."

|