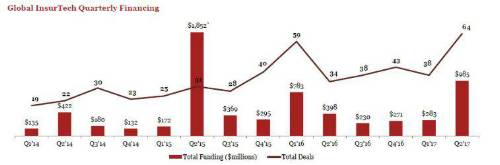

Global investment in InsurTech in the second quarter of 2017 surpassed that in the previous three quarters combined, according to a new report from PwC.

Investment in InsurTech by global insurers, reinsurers and Venture Capital firms surged by 247% to $985million, compared to Q2 2016 ($398million). The first three months of 2017 saw $283million of InsurTech funding.

PwC predicts the rate of funding and investment will continue at a similar level and the report highlights an uptick in interest in InsurTech from the reinsurance industry as sentiment turns from fear to bullishness, and from scepticism to collaboration.

Figure 1: Global InsurTech quarterly Financing Source; PwC Corporate Finance LLC, InsurTech Insights, July 2017

Note: 1Funding in Q2’15 includes a $931m capital raise by ZhongAn Insurance, a Shanghai-based internet insurance company

While concern about disruption and loss of market share undoubtedly remains, reinsurers have noticed that a new wave of startups are focused less on disrupting the entire industry and more on redesigning specific areas of the value chain. This offers an opportunity for reinsurers to work alongside these innovators. The report notes that reinsurers have begun to realise how exploring new technologies and talent groups can help them play a leading role in transforming their industry.

In this new world, collaboration is key. And, although 82% of reinsurance companies say they plan to partner with InsurTechs, some hesitation undoubtedly remains. PwC argues that the reinsurance industry has fostered a successful culture of stability, self-reliance and gradual change but for innovation, this can be an impediment.

The report states that now is the time for all insurers and reinsurers to work with innovators to modernise the industry.

Commenting, Patrick Maeder, EMEA insurance consulting leader at PwC, said: “A change has happened in insurance and it’s hugely encouraging to see both insurers and reinsurers increasingly view InsurTech as an enabler rather than a competitor. This uptick in enthusiasm is vital to ensure the industry engages with innovators to help shape its own success. Neither party can survive this wave of disruption on its own and a collaboration between experienced industry players and new ideas and technology will result in new products, reduced costs and more engaged customers.”

“InsurTech innovators have rapidly established themselves as the backbone of innovation in this industry but reinsurers should not be overly concerned about startups directly disrupting their product offerings. They should instead focus on what makes their business unique and where they see future growth coming from. Reinsurers then need to find the best way of directly working with this new wealth of tech-savvy talent to place themselves at the heart of what will undoubtedly be a transformation for their business and the wider industry.”

|