Research from Legal & General Investments shows that investor confidence has stabilised during the past year.

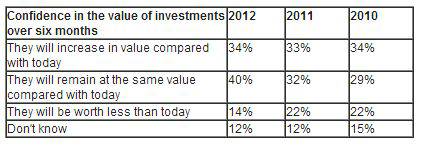

A third (34%) of investors are confident in their investments and the market, anticipating an increase in the value of their portfolios over the next six months. This is a small increase on 2011 when it was 33%. While two in five investors (40%) expect no change to the value, which is an 11% increase from 2010.

Significantly, just 14% expect a decrease in the value of their investments, a 6% drop from last year.

The findings come from Legal & General Investments' What Matters Investment Index which investigates investors' views of the market and is now in its third year.

Despite volatile markets investors are anticipating a level of return that exceeds most cash alternatives from their investments, with 29% expecting 2.5%-4.99%, while 8% expect 7.5% and above. The average expected return is 4.32%. Men remain more confident (38%) than women (28%), while the over 55s are the most pessimistic investors with 14% expecting a decrease in the value of their investments.

Wales shows itself to be the most confident region with nearly half (45%) of all Welsh investors believing they will see an increase from their investments in the next six months.

Simon Ellis, Managing Director, Legal & General Investments, said: "In the current economic climate, and following a period of extreme market volatility, it is heartening to see investors' confidence stabilise. The research indicates that there is an increasing sense of positivity with a substantial decrease in the number of investors who expect a fall in the value of their investments."

He continued: "It appears that investors are in it for the long haul and having navigated difficult waters and turbulent times, now is the time to re-assess investment ambitions carefully. One would hope this will enable the industry to re-engage with customers more positively after RDR in 2013. It is certainly an opportunity to look at asset allocation and think about portfolio diversification with a trusted, heritage brand to help manage that investment journey."

|