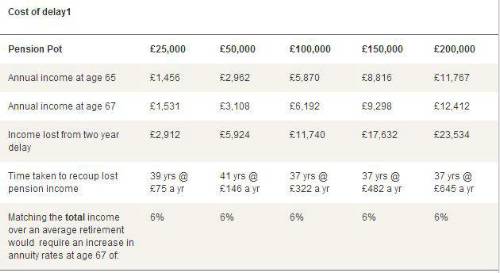

MGM Advantage has analysed whether it could pay to delay your annuity purchase in the hope that rates will continue to improve and you might increase your income in the future. By delaying your annuity purchase by just two years, you will receive a higher income because of your age. But the company has calculated if annuity rates stayed the same as they are today, the income lost from those first two years would take a further 37 to 41 years to recoup. The average life expectancy for a man aged 65 is currently a further 21 years and for women 24 years.

The company has worked out annuity rates would need to improve by at least 6% from today's rates to break-even on the total income you could receive over an average retirement. But that break-even point in total income would come 19 years after you purchased your annuity because of the two year delay. If you are hoping rates would improve to the point you would receive a better overall income, then rates would need to increase by more than 6% from todays' rates and you would need to live at least the average time in retirement to make any delay beneficial.

Andrew Tully, MGM Advantage commented: "We have seen annuity rates improve over the first half of the year, from their historic lows in 2012, but the long-term outlook for rates is uncertain. It would take a betting man to take a punt on annuity rates improving by at least 6% over the next couple of years to make any delay worthwhile. If rates improved by 6% from today, it would be around 19 years into your annuity being set up for you to break-even on your total income. Many people will want and need to generate an income from their pension now, not be able to afford to wait in the hope that rates will significantly improve.

"There are many factors currently affecting annuity rates. Gilt yields remain low, quantitative easing is still in the background, people are generally living longer and the impact of Solvency 2 is yet to be fully felt, so there is no guarantee rates will improve enough for any delay to pay off."

The following table shows the impact of delaying your annuity purchase and the time period to make good that shortfall if rates remain at the same level as today.

Andrew Tully continued: "It has been said buying an annuity is a gamble. But then so is delaying your annuity purchase in the hope rates will improve. Many people simply won't be able to wait to buy an annuity, but there are ways to maximise your income. Never accept the offer from your pension company, always shop around for the right shape annuity as well as the best rate.

"For example, if you have a medical condition or smoke you are likely to receive a higher income from an enhanced annuity. If the ability to vary your income is important to you, then investment-linked annuities can offer a higher starting income than conventional annuities, although you do need to be comfortable with some risk. Seeking professional financial advice is key to ensure you select the right product or products as well as securing the best rate."

|